BTC Recovery Underway

Bitcoin bulls are enjoying some relief today with Bitcoin futures rebounding as we cross through the middle of the week. Following heavy selling on Friday , the market found fresh demand into a test of the 53,525 level and is now turning higher once again. It seems the correction lower proved an attractive proposition for those banking on an eventual resumption of the bull trend in BTC. Industry data shows huge BTC ETF inflows over the last 3 days as institutional investors bought the dip. More than $650 million in inflows were seen since July 5th with BlackRock alone recording almost $200 million of that. The fresh wave of demand suggests that belief in a continued BTC rally remains strong.

Huge ETF Inflows Seen

In terms of the macro backdrop for BTC, the market has been under sustained pressure recently amidst heavy selling from both German and US governments, and the offloading off the Mt. Gox bankruptcy estate. However, the last few days’ worth of ETF buying looks to have stabilised the market for now.

US Inflation & Fed Expectations

Looking ahead this week, focus will be on the US Dollar and Fed easing expectations. Speaking yesterday, Fed chairman Powell’s comments were broadly neutral, citing plenty of two-way risk dependent on the path of inflation. With that in mind, tomorrow’s US CPI data will be paramount. For BTC bulls, a fresh decline will be the best outcome, leading to increased near-term easing expectations and a lower US Dollar. If we see any upside surprise, this could well drag BTC lower again as USD rallies.

Technical Views

BTC

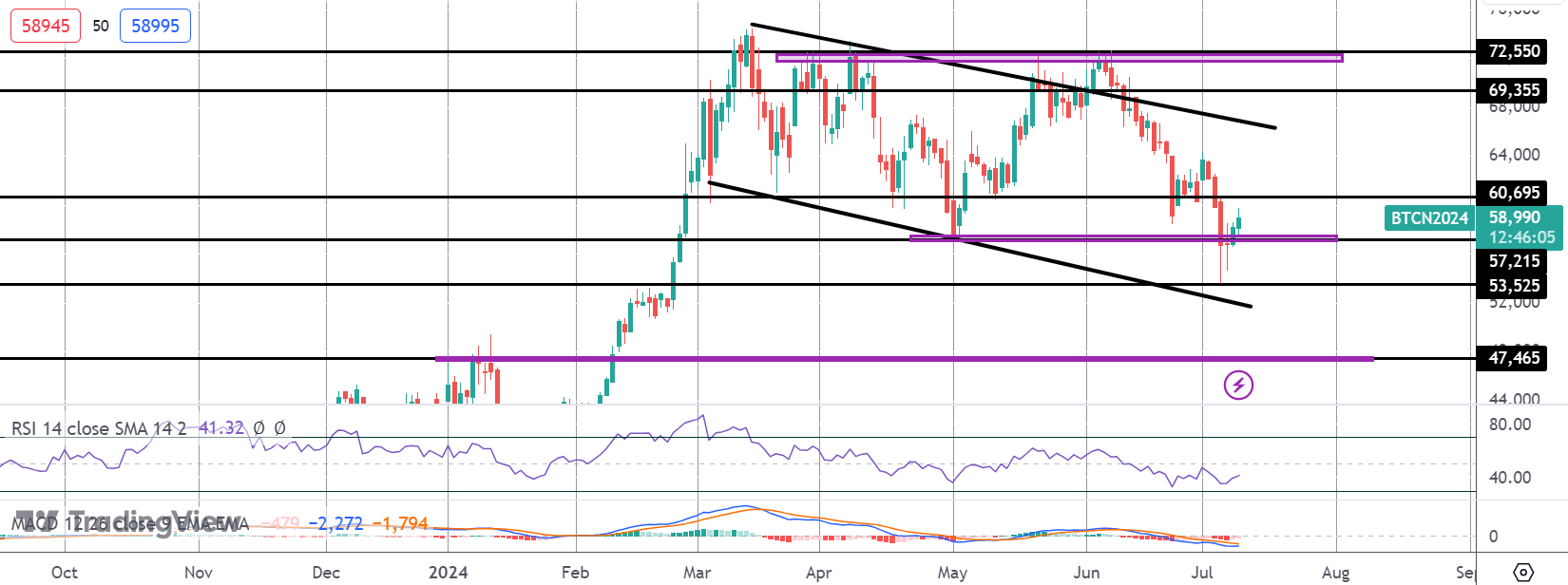

The sell off in BTC has stalled for now into a test of the 53,525 level with price since bouncing back above the key 57,215 level. While above here and with momentum studies turning higher, focus is on a fresh rotation to the upside with 60,695 the local resistance to note, and the bear channel highs above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.