Bitcoin Remains Muted

It’s been a disappointing week for Bitcoin bulls with the leading crypto asset seen lower on the back of the April halving event. There had been plenty of speculation ahead of the event regarding the potential for a fresh rally on the back of supply being reduced. However, this upside has yet to materialise and despite some initial strength, BTC futures have drifted lower over the last week of trading.

Pre-Halving Rally Fades

One likely reason for the current malaise we’re seeing is the heavy rally we saw ahead of the halving event. BTC futures rallied around 90% off the YTD lows into the March highs printed a few weeks ahead of halving with buyers capitalising on bullish anticipation ahead of the event. Analysis of prior halving event shows that BTC is typically lower in the three months post-halving before going onto print fresh highs over the 12 months post-halving. With that in mind, the current consolidation and correction in BTC might last longer and push a little deeper before upside resumes.

Shifting Fed Outlook

A shift in Fed expectations has also created near-term headwinds for BTC. With the market having pushed out its expected date for initial Fed easing from June to September, USD has remained firm in recent months. This shift has halted the prior rally in risk assets, stunting upside momentum in crypto also. However, if this picture starts to shift over the summer (essentially, if we see inflation start to fall again), this should reignite easing expectations, driving a fresh rally across risk assets including crypto.

Technical Views

BTC

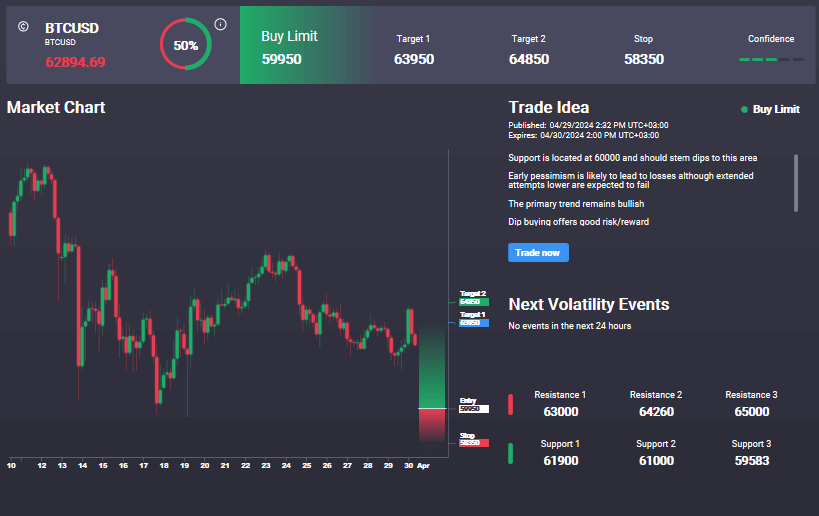

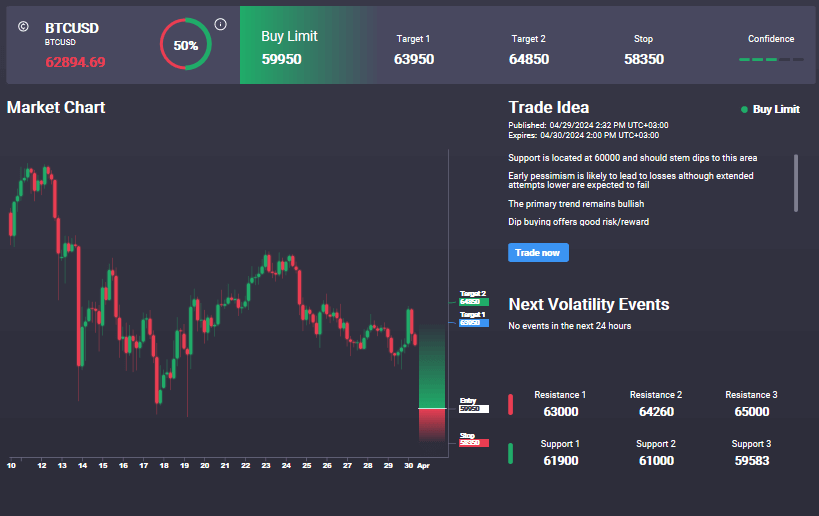

For now, BTC remains within the 60695 – 74325 range which has framed price action over the last two months. Price is currently testing the contracting triangle low, around the 65450 with and with momentum studies bearish, a fresh test of range lows is in sight. Should we break lower, 49425 will be the broader bear target. In the Signal Centre today, we have a bullish signal 59950 suggesting a preference to fade any move lower.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.