Bitcoin Slides As Trump Reignites Trade War

BTC Slides from Highs

Bitcoin prices are seeing better demand today with the futures market tentatively in the green following a heavy drop lower on Friday. Weaker-than-forecast US jobs data (sparking fresh US economic fears) and the resumption of sweeping US trade tariffs combined to spark a bearish shift in sentiment across risk markets on Friday. The crypto market was no exception to this change in trader tone with BTC futures shedding around 3.4%, now down around 8% from the record highs printed last month.

Investor Uncertainty

With a fresh uptick in investor uncertainty linked to the US trade war, Bitcoin prices now look vulnerable to further downside depending on how we see cross-market moves develop this week. For now, BTC looks to be tracking the move sin USD which is itself stabilising following Friday’s plunge. If USD takes a fresh turn lower this week, however, BTC could easily retest the broken 2024 and prior 2025 highs around the $108 level.

Bullish BTC Forecasts

Looking further out, however, the broader bull view in BTC remains intact. If trade tensions ease in coming months, through renewed negotiations and fresh trade deals, this should help bolster risk appetite. Furthermore, if the Fed does push ahead with a rate cut next month, this should be firmly bullish for risk appetite, helping lift crypto prices through Q3 into Q4, in line with the large scale corporate and institutional buying forecasts we’ve seen recently.

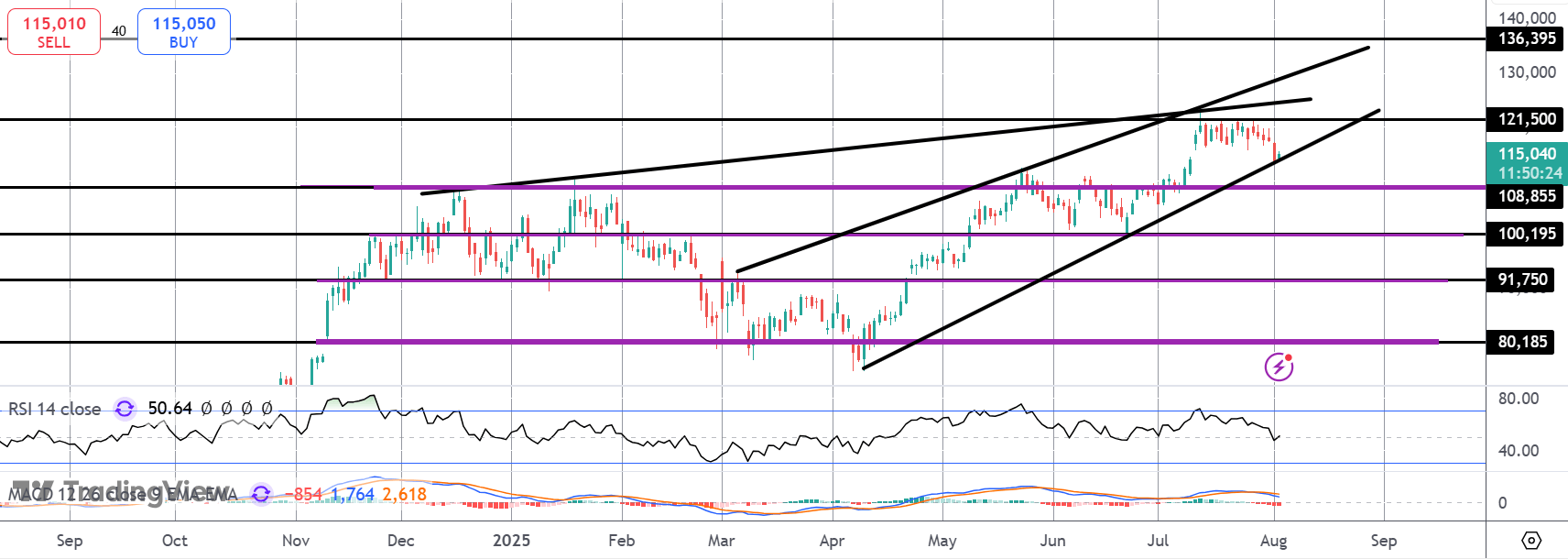

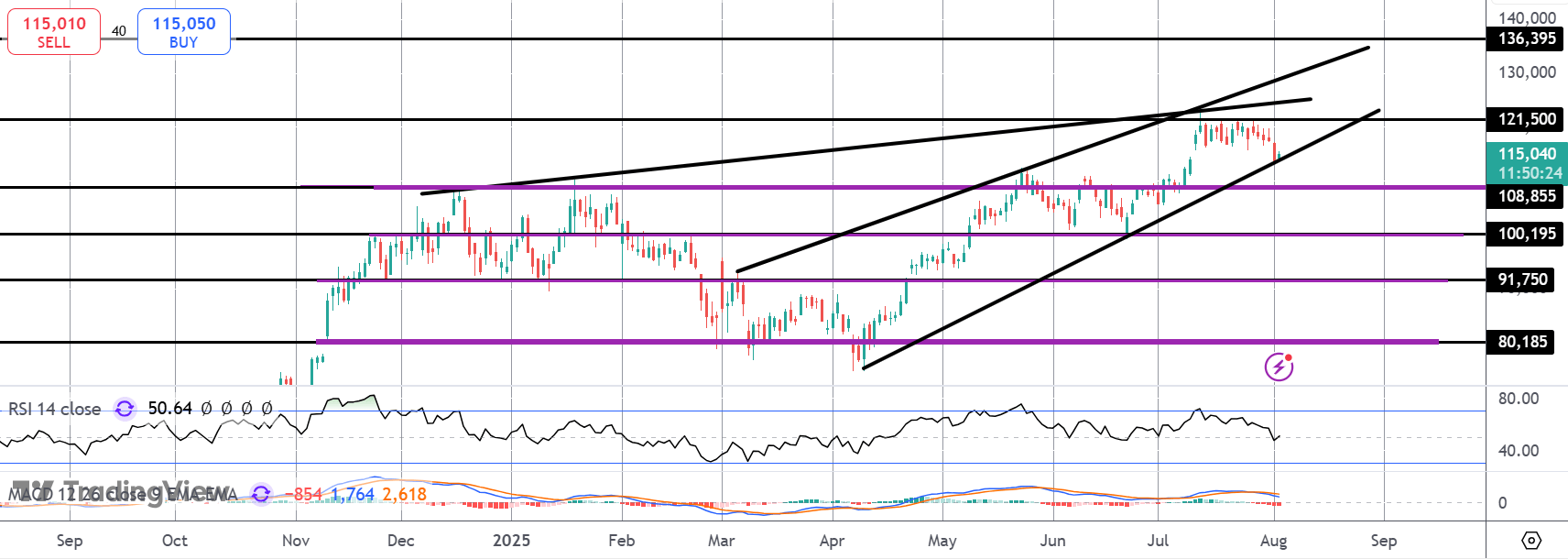

Technical Views

BTC

The rally in BTC has stalled for now into the $121,500 level with price also capped by the bullish trend line resistance from 2024 December highs. Currently underpinned by bullish channel support, focus is on a fresh push higher and a move towards $136,395 next, while price holds above $108,855.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.