BTC Drops Amidst Risk-Off Markets

Bitcoin bulls have taken a beating this week. Following the sustained buying we saw through September, the first trading days of Q4 have seen the market coming under heavy selling pressure with BTC futures now trading back below the August highs. The move lower comes amidst the recent uptick we’ve seen in USD in response to Fed chair Powell pushing back against .5% rate-cut calls.

Powell Rates Pushback

Powell warned earlier this week that the Fed was not in hurry to cut rates, with the economy deemed to be on solid ground. As such, Powell signalled that the Fed’s base-case scenario, is for two further cuts of .25% this year. Market pricing for a deeper November cut quickly faded on the back of these comments, sending USD higher and curbing risk appetite across the board. Coupled with growing uncertainty over the conflict in the Middle East, BTC has been heavily sold this week.

ETF Outflows

The latest industry data points to heavy ETF outflows this week, which have also led BTC lower. As of Tuesday, BTC ETFs saw outflows of $243 million, the worst day of leakage in a month. The selling means that October, typically one of the best performing months for BTC, is getting off to a shaky start. Looking ahead, focus will now turn to tomorrow’s NFP release with bulls hoping for weak data to help curtail the Dollar rally and bolster easing expectations once again.

Technical Views

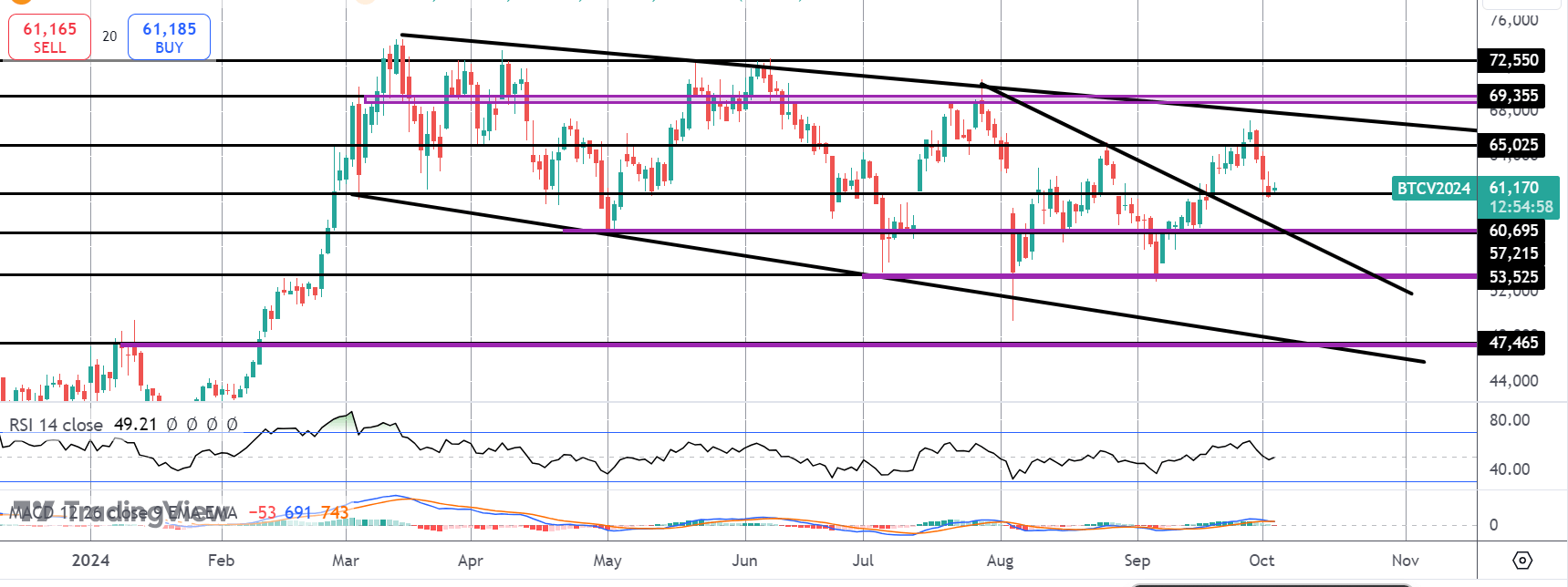

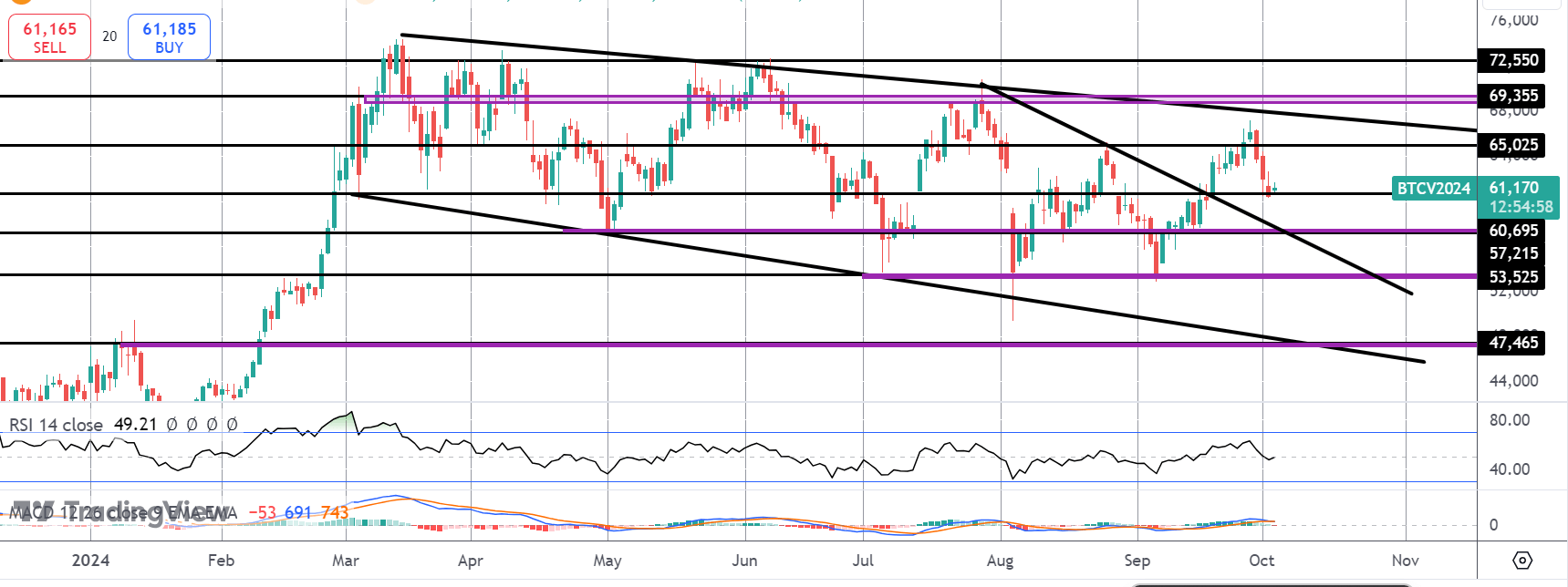

BTC

The rally in BTC has stalled for now into the bear channel highs with price since turning back under the August highs. Price is now testing support at the 60,695 level. Bulls need to hold price above the 57,215 level and the broken bear trend line to keep focus on a fresh push higher and a resumption of the bull trend.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.