ETH Lower on Wednesday

Ethereum prices are trading lower through the middle of the week, tracking the moves we’re seeing in Bitcoin as the broader crypto complex softens. The move lower comes despite an uptick in risk assets this week as traders respond to comments yesterday from Fed’s Powell who confirmed that the US is back on a disinflationary path. Powell noted that the bank is still looking for further evidence of the disinflationary move before committing to rate cuts. However, the comments have proved enough to spark a rally across risk markets, but not in crypto for now.

FOMC Minutes & NFP

Looking ahead this week, ETH bulls will be hoping for some dovish surprise in tonight’s FOMC minutes or a downside surprise in Friday’s US jobs data to help drive a proper sell off n USD, which should help revive crypto demand. Beyond that, the focus for ETH traders is the expected launch of ETH ETFs which are expected to begin trading as early as next week. If we see a wave of inflows, similar to when the BTC ETFs launched earlier this year, this should help drive ETH prices higher.

Bitcoin Impact

For now, ETH is under pressure due to the weakness we’re seeing in BTC linked to the Mt. Gox estate sale. As part of its bankruptcy process, around $8.5 billion worth of BTC is being returned to creditors. If creditors choose to cash out instead of hold onto their coins, this flood of supply is expected to take BTC lower near-term before the market stabilises. However, the dynamic should prove temporary and could create better levels for long term bulls to reload.

Technical Views

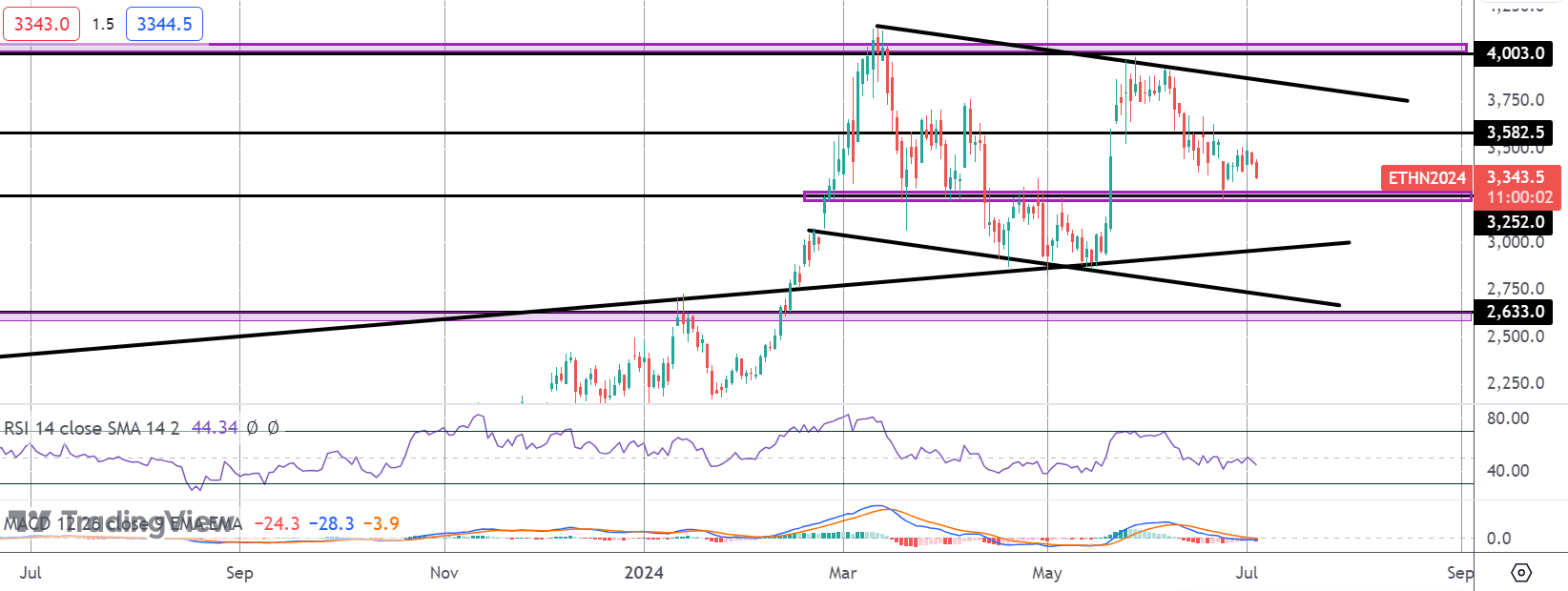

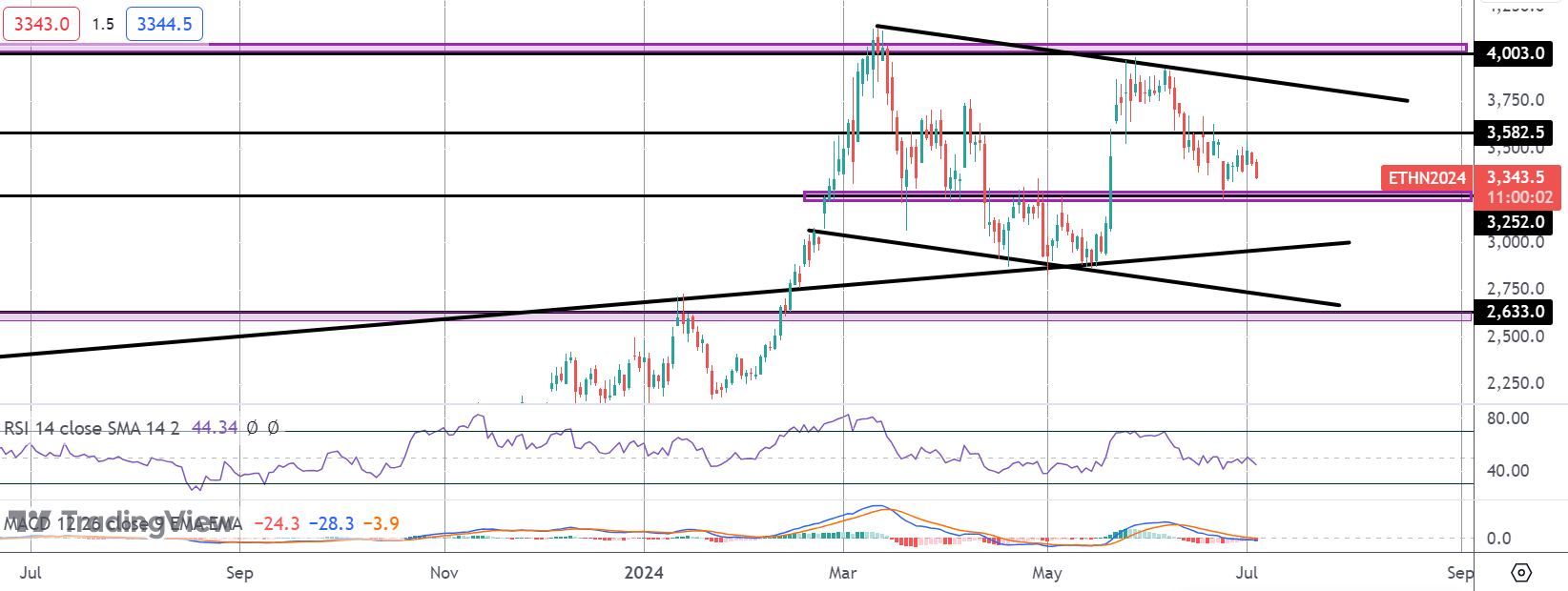

ETH

The sell off in ETH has seen the market trading back down to the 3,252 level which is holding for now as support. With momentum studies weakening risks of a downside break are growing. Below here, the bull channel lows will be next support ahead of deeper structural support at 2,633.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.