Correction Lower Continues

Bitcoin bulls are starting the final full trading week of the year with a sense of caution today as BTC futures continue to trade lower. The move, which appears linked to profit taking ahead of year-end, has seen the market turning back down towards the December lows around 40435. However, another reason for the sell-off looks to be the continued unease over high transaction fees. Fees are now back up record high levels last seen in April 2021. One view is that the current correction will continue lower until fees fall to such a level that demand is encouraged once again.

Bullish Bitcoin Outlook

Beyond the current market dynamics, the outlook for Bitcoin remains bullish across the start of 2024. With the Fed now widely expected to cut rates in H1 2024, the SEC expected to announce initial approvals on spot-BTC ETF applications and the April 2024 Bitcoin halving event ahead, there are many reasons that we might see a fresh move higher in BTC. As such, the current pullback might simply offer better entry levels for longer-term players looking to position for next year.

Technical Views

BTC

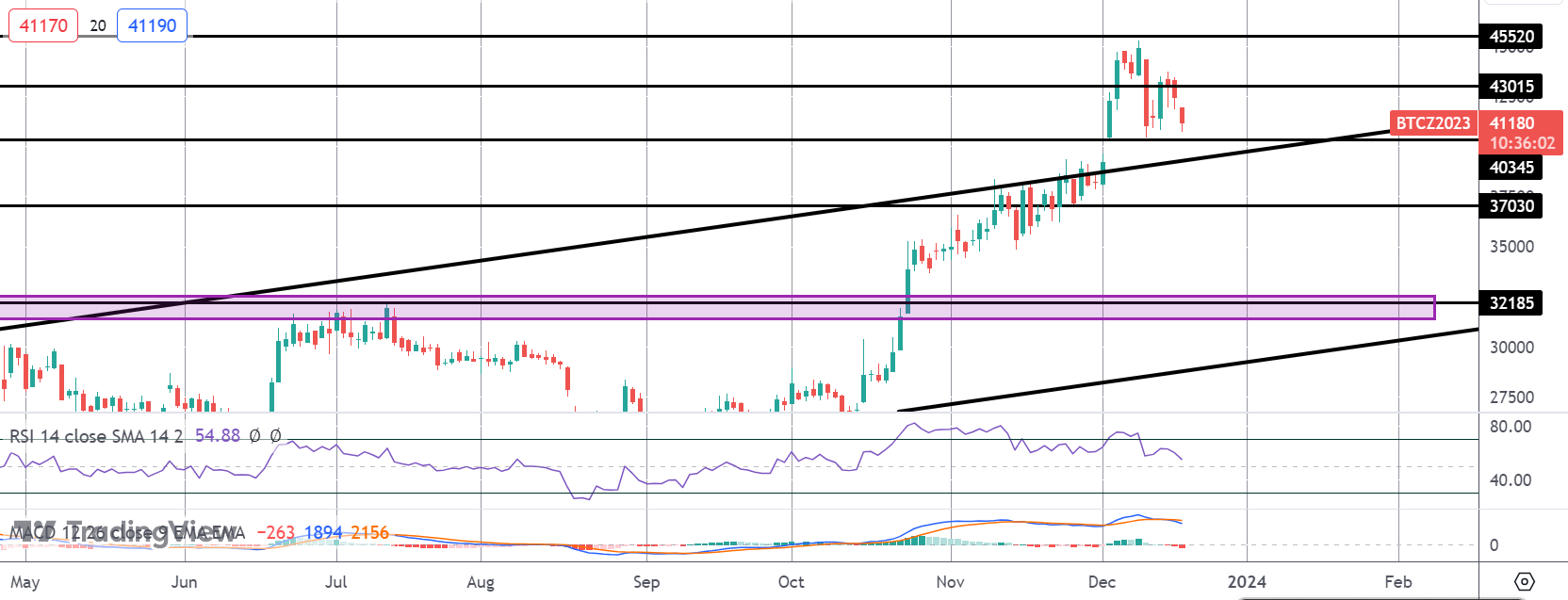

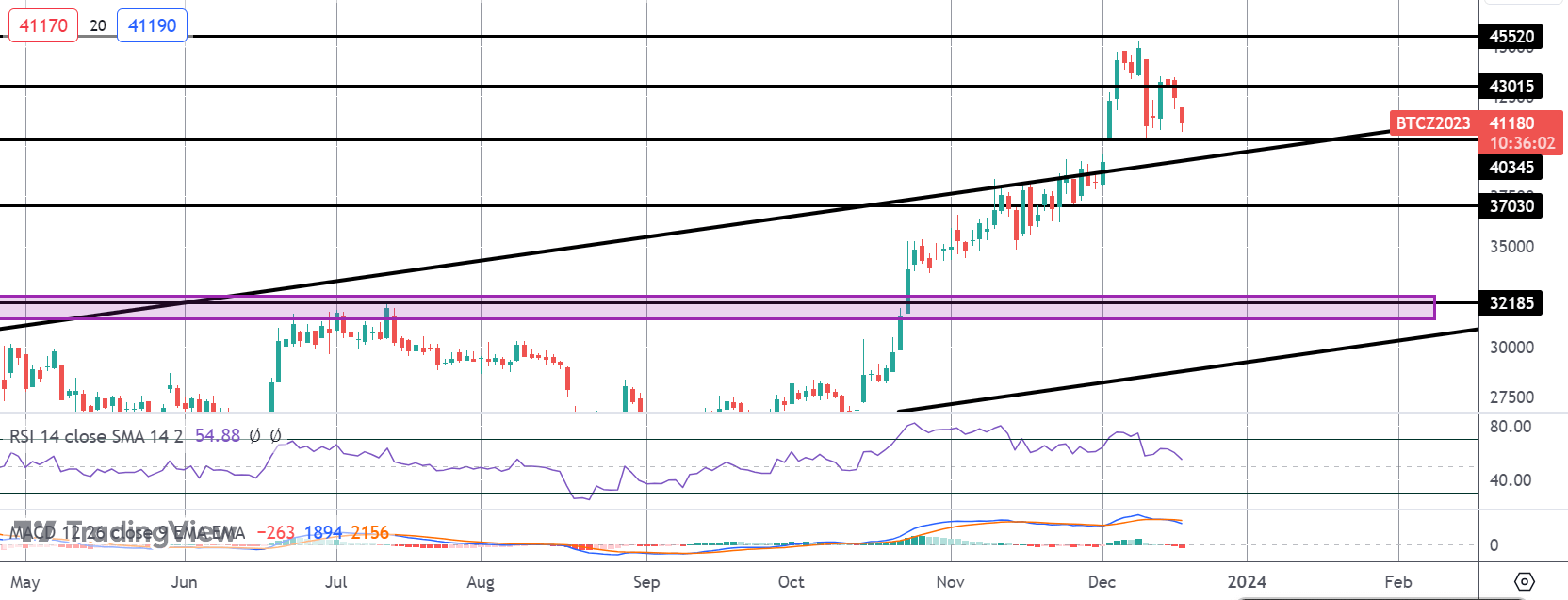

The failure at the 45520 level has seen the market reversing lower with price now once again retesting the 40345-level support. This is a key area for BTC with a break below there opening the way for a deeper push down to 37030. While this support holds, however, focus remains on a continuation higher with a break of 45520 the first objective for bulls early next year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.