Bitcoin Rallying on Trump 401K Optimism

BTC Pushing Higher

Bitcoin prices are looking a little softer so far today following a sharp rally yesterday. The futures market jumped around 3% higher yesterday in response to news that Trump is set to sign an executive order allowing for Bitcoin and other crypto assets to be included in 401k retirement plans. The inclusion of crypto in retirement portfolios has long been touted as a major bullish accelerator for the crypto market. Given the huge amount of capital which could then flood the crypto market (total 401k pool currently around $9 trillion), Bitcoin prices stand to gain sharply if the plan is approved and funds start to move into crypto.

Institutional ETF Demand

Surging institutional demand has been a key driver of the move higher in Bitcoin this year. With BTC ETFs live since February, total inflows recently reached record highs of almost $15 billion, making Bitcoin one of the most popular ETF asset classes. High profile purchases from big funds and corporates have added to bullish sentiment in recent months, most notably consistent buying by Michael Saylor’s Strategy fund which is now the largest global holder of Bitcoin. Against this backdrop, BTC looks poised for a fresh breakout near-term, particularly if Trump does sign this anticipated executive order, paving the way for a fresh surge in crypto demand.

Technical Views

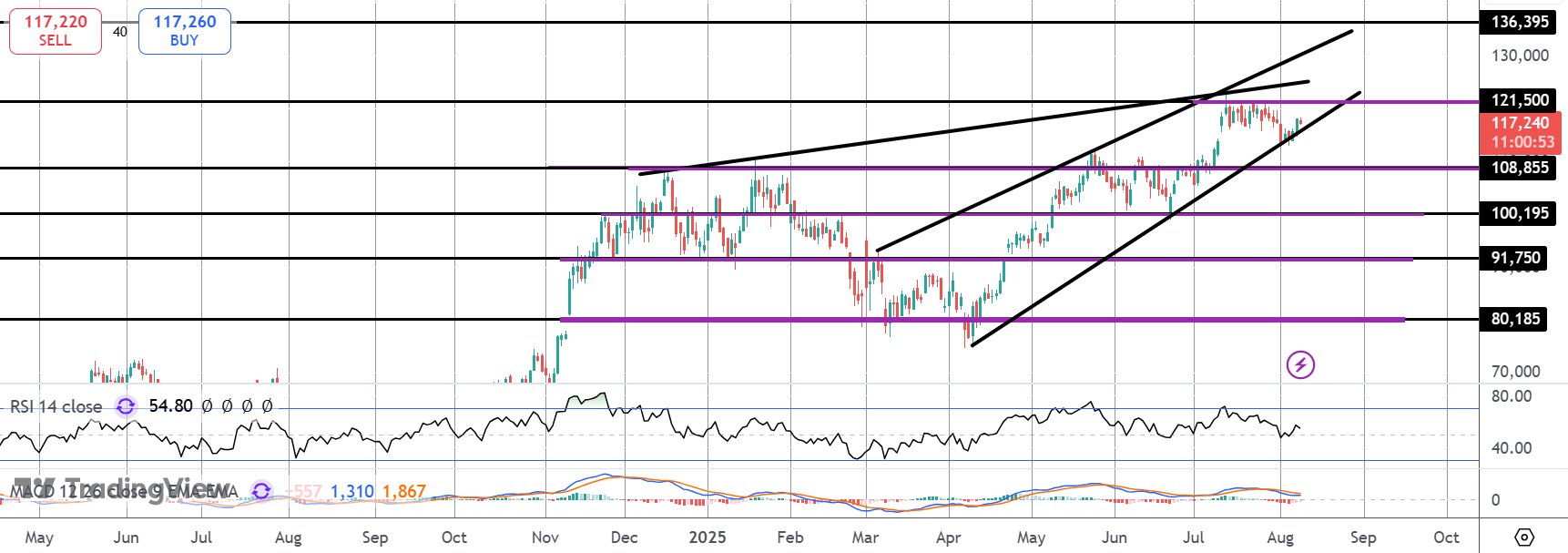

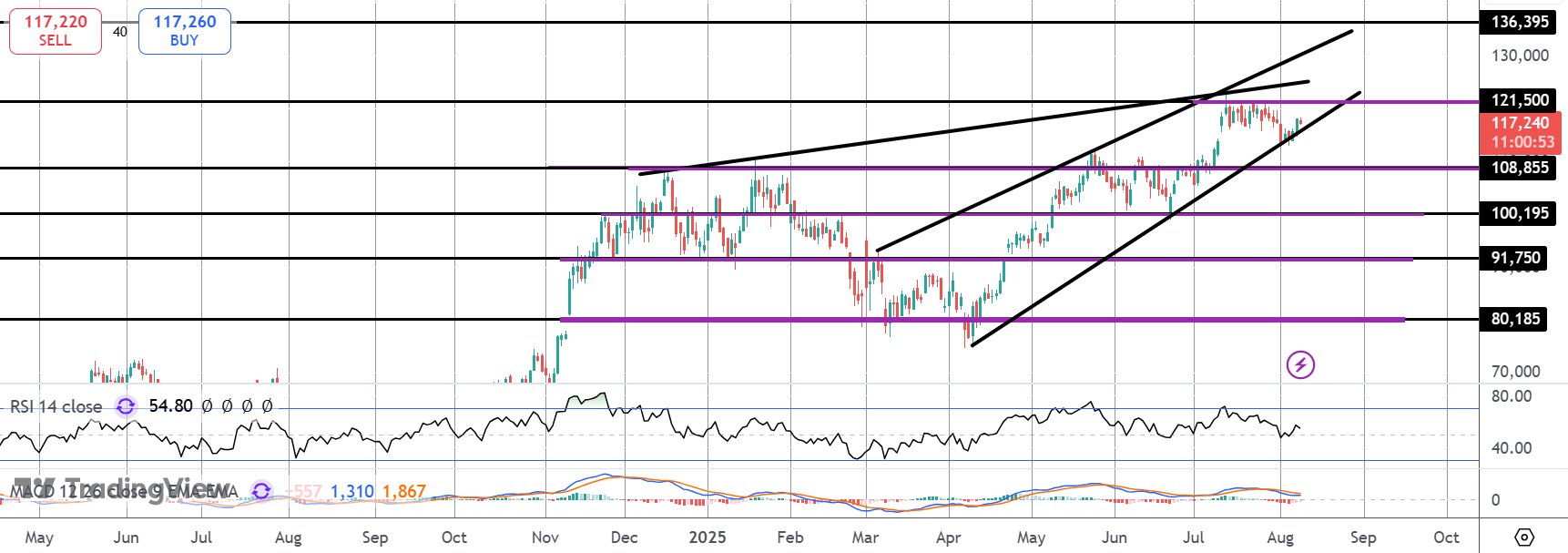

BTC

The sell off in BTC has found fresh support into the bull channel lows. Price is now turning higher again with 121,500 the key resistance level to watch. If bulls can get back above this level, focus turns to the higher Fibonacci extension target at 136,395. Worth noting that we are seeing some bearish divergence in momentum studies readings and price moving within a falling wedge pattern suggesting possible reversal risks. Longer term, the bullish outlook holds while price remains above 108,855.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.