Bitcoin Rallying On Dovish Fed Signals

BTC Rebounds Midweek

Bitcoin is bouncing back firmly midweek. Following a sharp drop lower yesterday. BTC futures have now almost entirely erased those losses, trading back up towards the key $108,855 level. The latest industry data reflects continued strength in institutional and corporate demand for BTC. Institutional buyers delivered more than $1.5 billion in net-inflows over the last three weeks despite the consolidation we’ve seen around current levels. With demand still growing and price holding just below ATH, the outlook remains skewed towards a breakout higher near-term.

US Jobs Data Due

Looking ahead, focus over the remainder of the week will be on US jobs data. Given the shortened US week, the ADP figure will be releases later today with the headline NFP data coming tomorrow, both a day ahead of typical release times. If we see fresh weakness in the US labour market, this will put greater focus on Fed easing expectations, leading USD lower and risk assets higher.

Powell Leaves Door Open to July Cut

Yesterday, Fed chair Powell reiterated the bank’s data dependent approach to policy and refused to rule out a July rate cut. As such, if we see any downside surprises in tomorrow’s headline data this should see July rate cut pricing spiking higher with BTC set to breakout as USD turns down. On the other hand, any upside surprises in tomorrow’s data should effectively rule out a July cut allowing USD to regain some ground into the end of the week, dampening BTC for now.

Technical Views

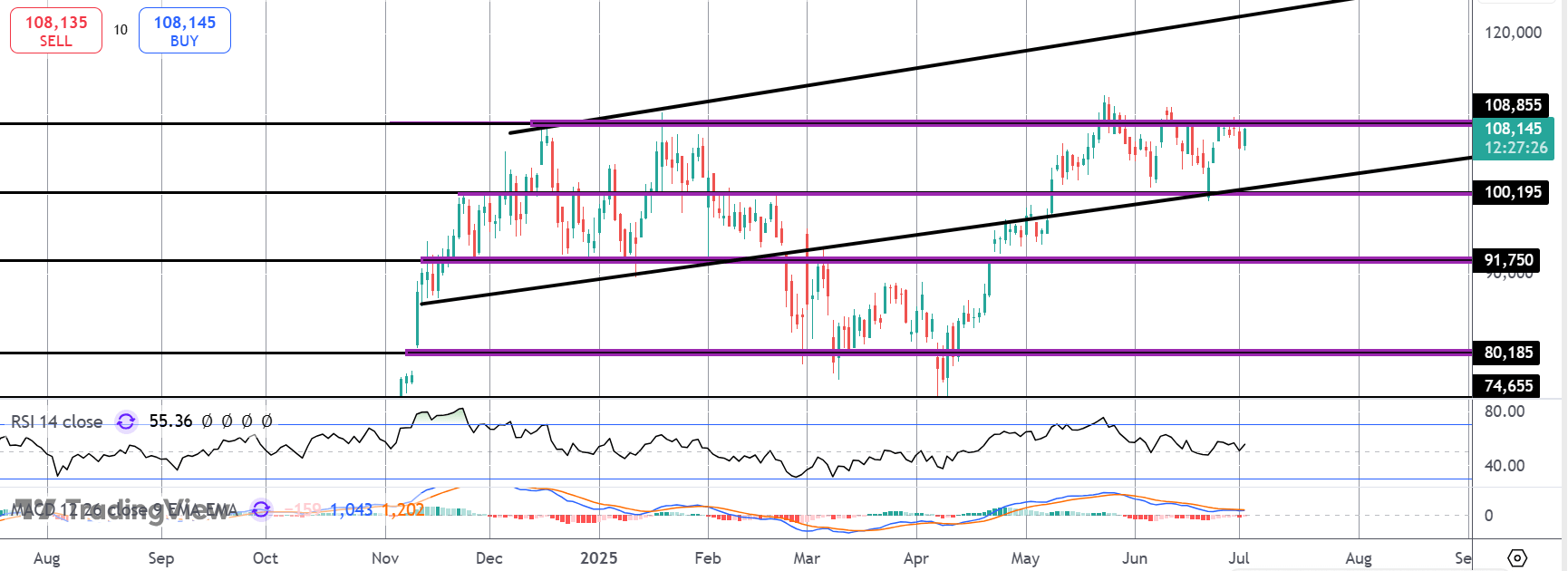

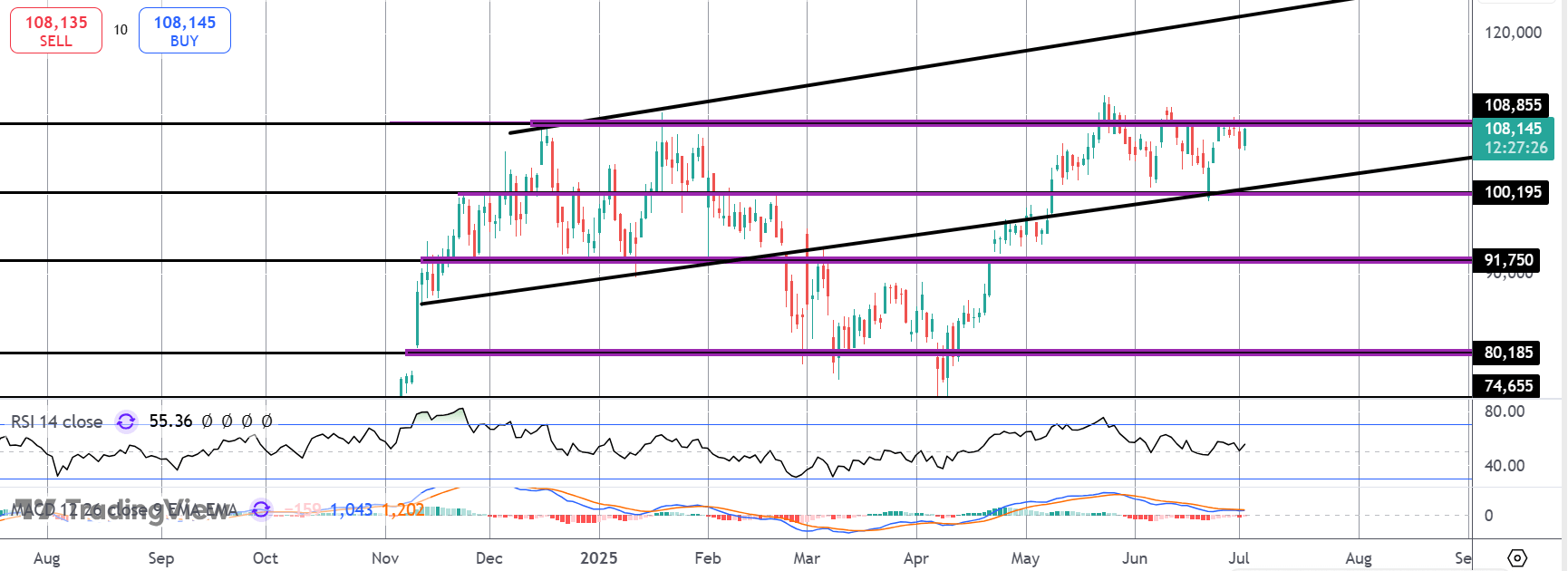

BTC

For now, BTC prices remain tightly coiled between support at the $100k mark and resistance at $108,855. While above $100k the focus is on an eventual break higher with the $120k mark and the bull channel highs the next objective for bulls. Only a break below $100k will shift this view, turning focus to $91,710 as deeper support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.