Trump in Focus

Following a brief correction lower over the first half of the week, Bitcoin prices are seeing fresh demand. The futures market is now trading back up towards the July highs with bullish momentum readings suggesting room for a continuation higher here. There is a great deal of optimism among crypto traders ahead of a keenly awaited speech by Trump at a major Bitcoin conference in Nashville on Saturday.

Crypto bulls are expecting the presidential candidate to outline his support for the crypto sector with some even speculating Trump might discuss plans to begin building a US crypto reserve if he wins office again. Reports this week show that Trump has already received over $4 million in crypto donations for his campaign funding, making him the first presidential candidate to accept crypto payments as part of campaign funds.

Bullish Crypto Outlook

Trump’s support for crypto is expected to be a major bullish factor for the market if elected in November. Bulls widely expect that Trump will scrap the strict regulatory environment which has created headwinds for the crypto sector in recent years. Lower tariffs, less tax and less regulatory restrictions overall could pave the way for a fresh ‘gold rush’ in crypto which should see higher prices in Bitcoin and the wider crypto market. Incoming polling results in coming months will therefore be key for the path of BTC with the market likely to rally if a Trump presidency looks more likely and fall back if it looks less likely.

Technical Views

BTCUSD

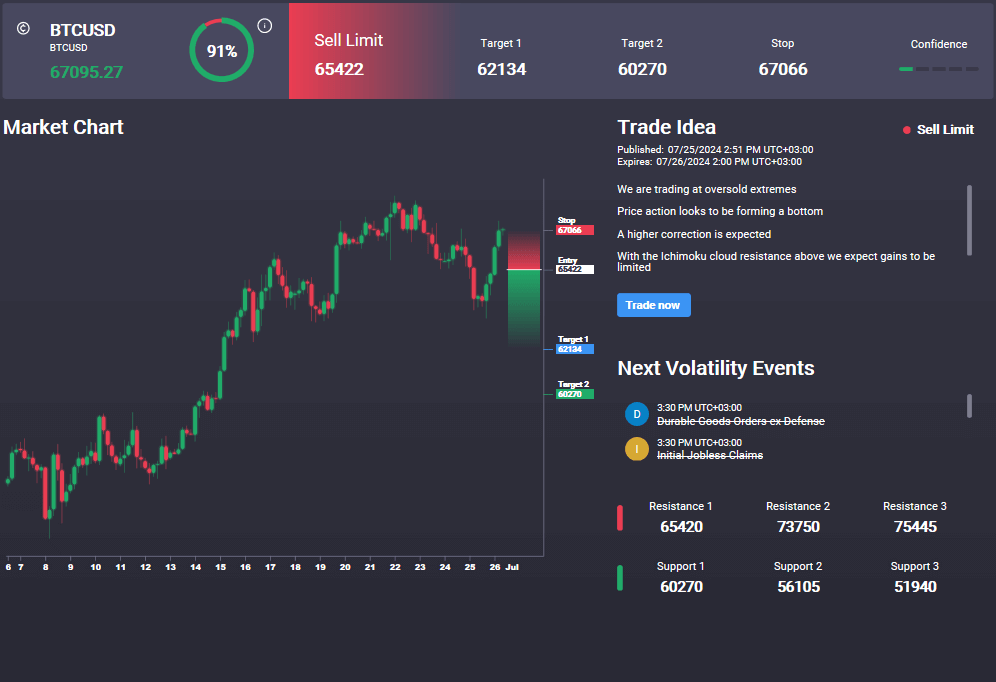

Following an initial breakout above the corrective bear channel from YTD highs, price is now turning higher again. With momentum studies bullish, the focus is on a continuation higher here with 69,355 the first hurdle for bulls before a test of the current all-time highs around 72,550. Interestingly, we have a sell signal in the Signal Centre today set at 65,422 suggesting a preference to sell a break of lows if price rolls over here.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.

.jpg)