BTC Rally Pauses

Following a strong start to the week, the rally in BTC has petered out for now with Bitcoin futures capped at the 69,355 level. The market was seen advancing strongly over up to Wednesday, with futures gaining 16% off last week’s lows as bullish sentiment took hold. The move had been linked to a shift in outlook on the US elections with traders again pricing in a higher likelihood of a Trump win following a downturn in that perspective over late summer.

Elections Uncertainty

Seen as the more pro-crypto candidate, Trump has been polling better in state surveys recently with some national polls showing him in the lead. Uncertainty ahead of the elections has been key headwind to crypto markets in recent months. However, as the elections draw nearer, traders are taking the view that either candidate should provide a boost simply through establishing some clarity in the political outlook.

Record ETF Demand

In recent days, industry data has reflected a strong surged in institutional demand via ETF inflows. Roughly $600 million worth of ETF inflow was recorded on Monday, marking record demand. The news will be seen as positive by BTC bulls hoping to capitalise on seasonal trends which point to October as being one of the best performing months for BTC. Looking ahead, ETF demand patterns into the US elections should remains a key driver of BTC price action, giving a good indication of how the market is likely to perform near-term.

Technical Views

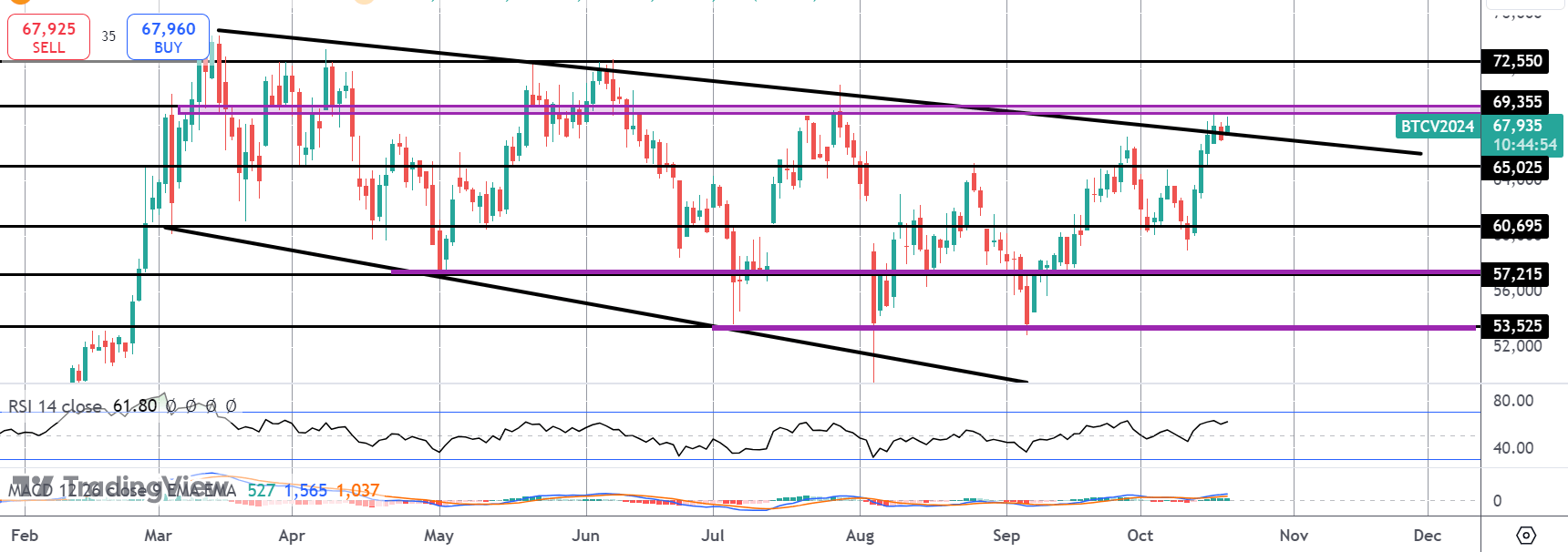

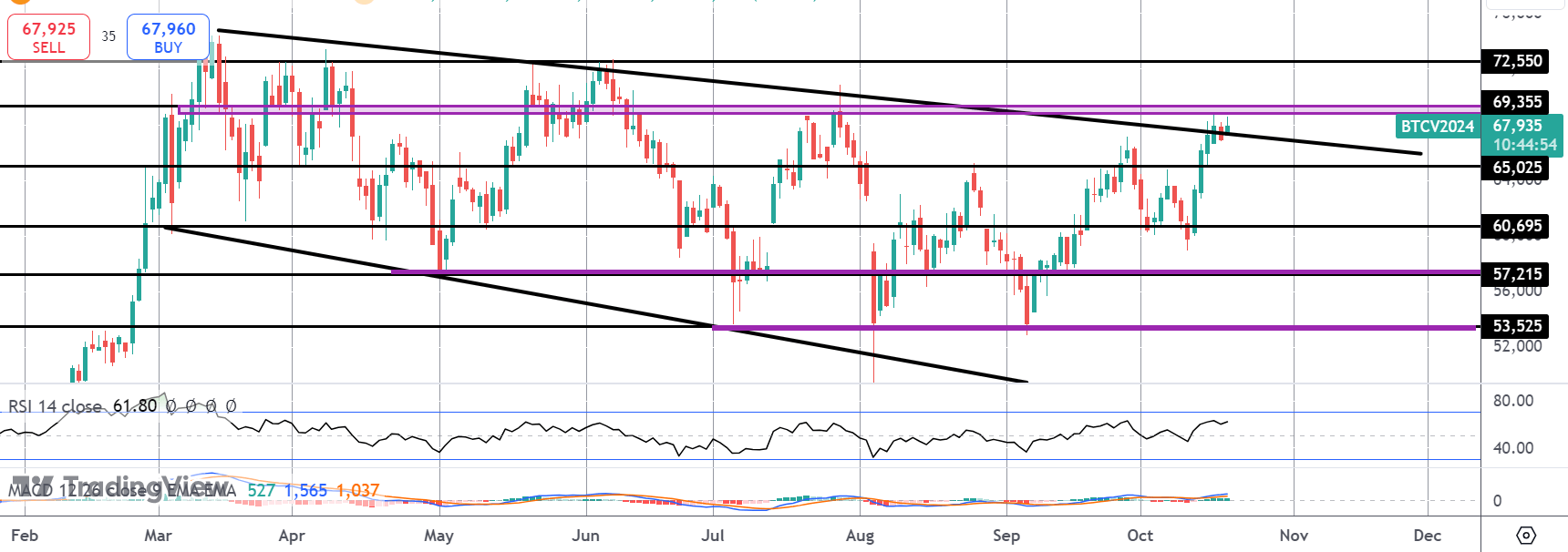

BTC

The rally in BTC has stalled for now into the 69,355 level and the bear channel highs. Momentum studies remain bullish here, however, keeping the focus on further upside with 72,550 the next upside target for bulls. Downside, 60,695 remains key support to maintain the bullish view.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.