Bitcoin Muted Following Fed Rate-Cut

Bitcoin Stuck For Now

A muted event from the Fed yesterday failed to drive any meaningful price action across asset classes. Whipsaw in USD means that directional cues have been thrown off for now though the broader bias is for risk assets to appreciate in coming weeks and months as Fed easing sets in again and the US Dollar resolves lower. For now, Bitcoin prices remain mildly bid with the futures market in the green today following some light downside yesterday. Congested price action reflects the lack of directional conviction for now, though the uptrend remains intact and while price holds above the $108,855 level, focus is on an eventual resumption o the bull trend and a fresh break higher.

BTC Inflows

In terms of what’s next for traders to focus on, ETF flows remain a key driver for BTC. Inflows have been rising steadily recently, reflecting a growing bullish bias among institutional traders. However, this has been offset somewhat by heavy retail outflows. Typically, however, this dynamic has preceded breakout moves in BTC, suggesting that a new bull phase might soon begin. Coupled with the fact that over the last decade, BTC has averaged returns of more than 80% over Q4, the stage could be set for a move higher in coming weeks.

Technical Views

BTC

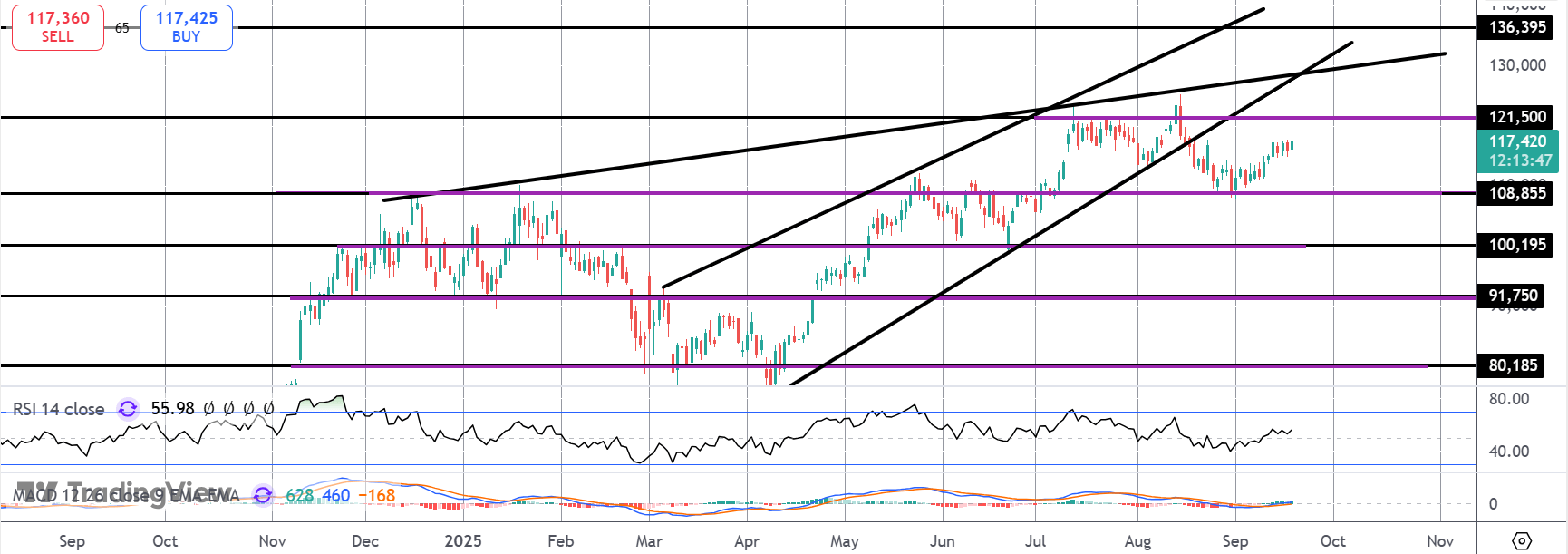

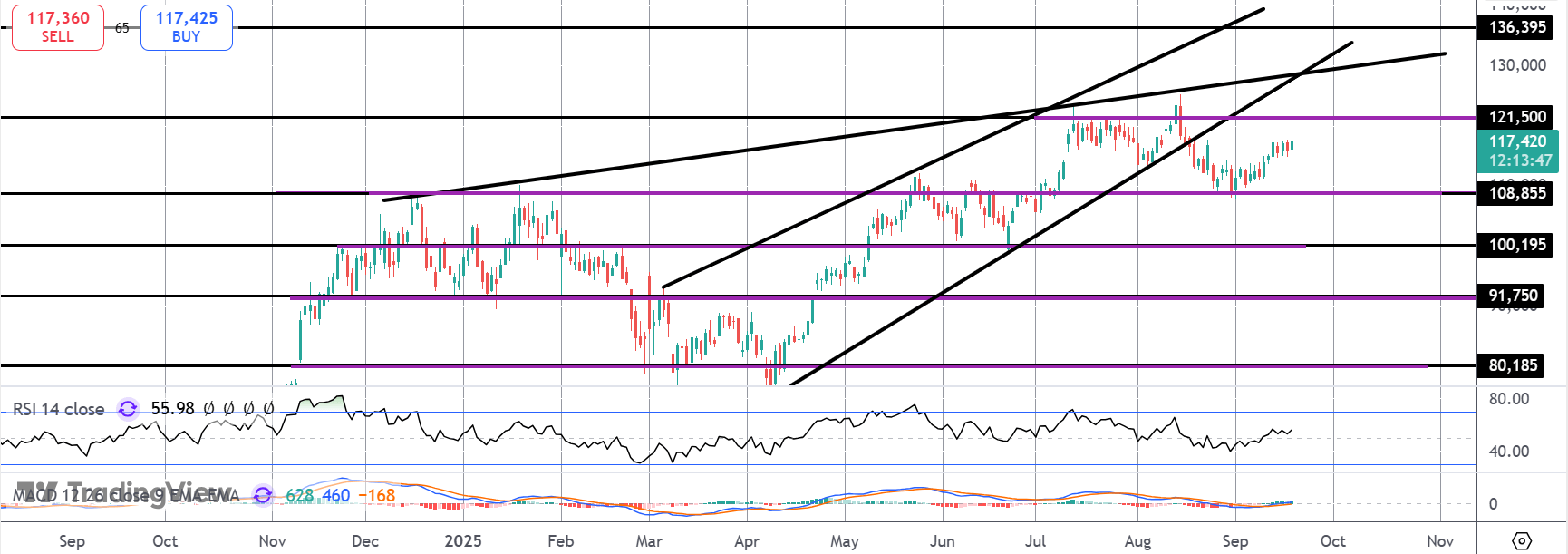

For now, BTC remains hemmed in between support at $108,855 and resistance at $121,500. While support holds, focus is on an eventual break higher with $136,395 the next target for bulls. Ahead of that level, however, we have converging trend line resistance to be aware of.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.