BTC Rout Continues

The Bitcoin sell-off continues to deepen this week with BTC futures now down more than 20% from the YTD highs. Selling since the SEC approved a slew of spot-Bitcoin ETFs earlier in the month has largely been attributed to fund outflows from holders who bought in long before approval was granted. In addition to this exodus, CoinDesk is also reporting that a further big source of outflows is linked to the FTX bankruptcy estate.

ETF Outflows

The Greyscale Bitcoin Trust in particular is drawing a lot of attention. The fund had existed (pre-SEC approval) for around a decade, drawing in capital on the basis that investors were getting in at a significant discount to NAV and would be in pole position at the point the fund was granted approval. With that approval now in place, many earlier buy-ins are taking the opportunity to cash out. FTX is said to have dumped around 22 million shares in Greyscale’s fund as part of its bankruptcy process.

Near-Term Outlook

With the FTX sales now completed bulls are wondering if the correction will abate and price will start to creep higher. The issue near term is that we are also seeing pushback from the Fed regarding near-term rate cut prospects. Expectations of a Q1 rate cut have fallen sharply in recent weeks amidst an uptick in CPI and less dovish Fed commentary. While this dynamic remains in place, BTC could well have further to run to the downside before we start to build a base to push higher again.

Technical Views

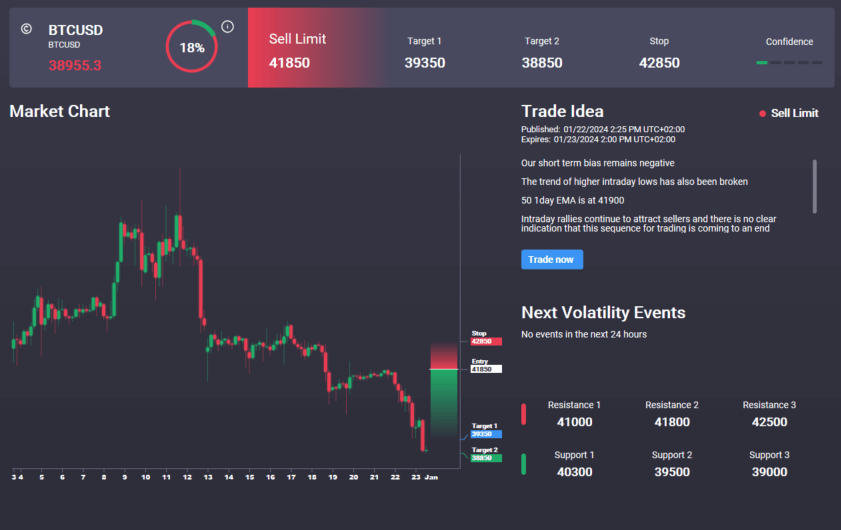

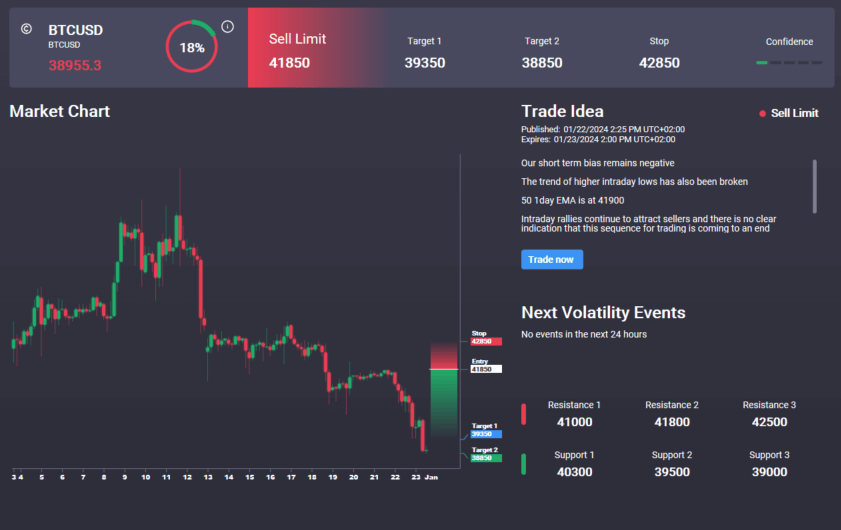

Bitcoin

The sell off has seen the market breaking back below the 40345 level and the bull channel top. While below here, the focus remains on a deeper push lower, in line with falling momentum studies readings. 37030 is the interim support to watch next ahead of the bigger support area down at 32165 where we have the bull channel lows also. Notably we have an active sell signal in the Signal Centre today set at 41850, suggesting a preference to sell any recovery bounces from here.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.