Bitcoin Drops On Profit Taking & Elections Uncertainty

BTC Pulls Back

Following a strong rally at the start of the week, Bitcoin prices have reversed lower over recent sessions. The futures market is now down more than 5% after briefly trading to new all-time highs earlier in the week. The driver behind the move lower has been linked to uncertainty ahead of the US elections next week as well as profit taking following a strong monthly gain in October.

Trump Election Odds

On the US elections front, BTC has been largely supported over the last month as a result of the increasing market view that Trump’s election chances have increased. Better polling results for the former president, a narrowing of the Harris-Trump lead in most national polls and a surprise shift in favour towards Trump on crypto betting site Polymarket (Trump ahead 65%/35%) have helped drive crypto market higher in recent weeks on the expectation that a Trump win will lead to a fresh crypto boom.

Sentiment Shift

However, in recent days, news has emerged that the better odds assigned to Trump on Polymarket are due to just four trading accounts placing thousands of bets, totalling around $50 million. The outsized bets have given Trump inflated odds. Since news emerged, Trump’s margin has dropped from 67% to just 61% in a few days. Traders will be watching these odds closely over coming days. If they continue to fall into the election, BTC is likely to follow them lower.

Technical Views

BTC

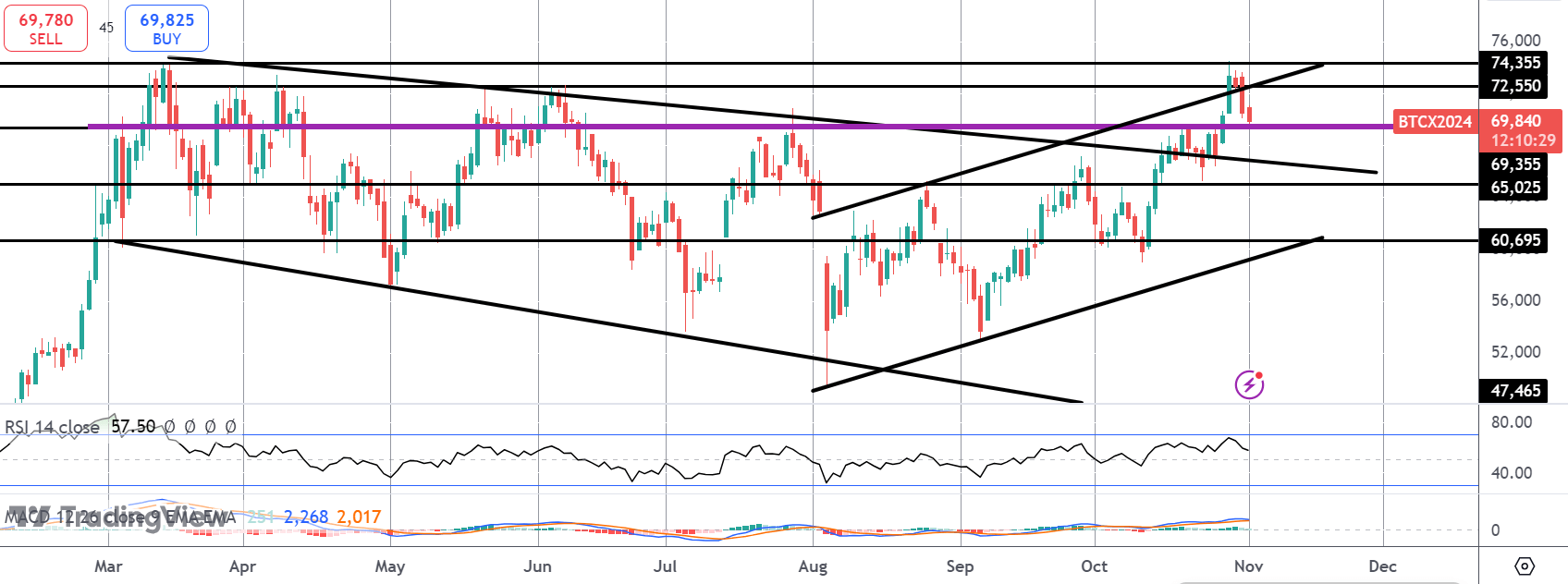

The rally in BTC has stalled for now into the former 74.355 highs. Price has since reversed and is now retesting support at 72.550. This is a key level for the market with bulls needing to hold above here to keep the near-term bias bullish. Below, 65.025 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.