Bitcoin Bulls Still Holding For A Fresh Breakout

BTC Volatility Persists

Bitcoin prices remain volatile and directionless so far this week. Following a surge higher in Bitcoin futures on Monday, the market reversed those gains entirely yesterday and is now sitting around the weekly opening price. The move lower yesterday came reflects an uptick in investor uncertainty in response to reports that the US is considering joining Israel’s war against Iran. Trump left the G7 summit early to meet with national security team at the White House.

US & Middle East

Trump has called on Iran to fully surrender or risk possible US intervention. The risk of such an escalation and the ramifications for stability in the wider Middle East is weighing on sentiment in crypto markets this week. If the US does join the war, this could spark a much fuller risk-off reaction across markets, opening the way for heavily lower prices in BTC near-term. On the other hand, if Iran does surrender (outside scenario) this could spark a relief rally.

Soaring Institutional Demand

Despite the downside in BTC yesterday, there looks to be a residual layer of demand kicking in each time the market turns lower. This likely reflects the huge institutional demand we’re seeing in the market as big players continue to focus on an eventual break higher. This week, both Michael Saylor’s Strategy fund and Japanese investor Metaplanet have announced fresh BTC purchases with Strategy purchasing over $1billion in BTC. This comes alongside data reflecting continued strength in BTC ETF inflows as mainstream investors hold onto the view that a breakout is still on the cards. While this demand backdrop holds, downside moves should remain limited near-term.

Technical Views

BTC

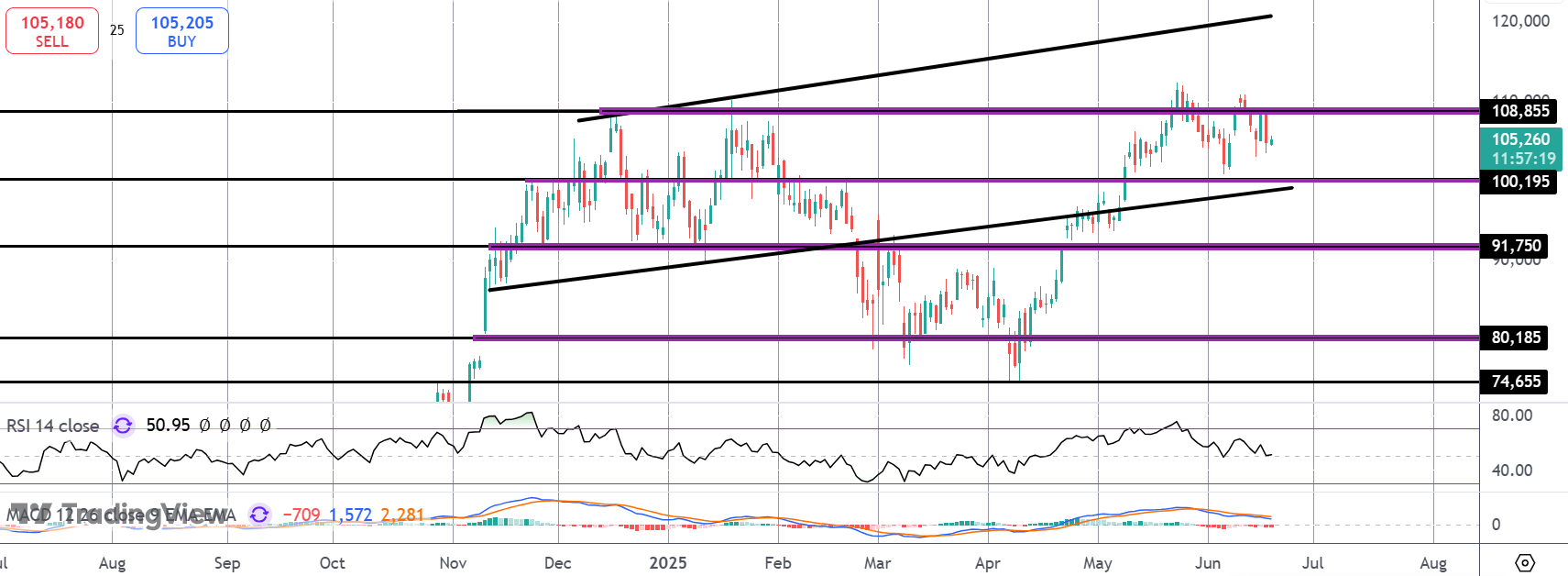

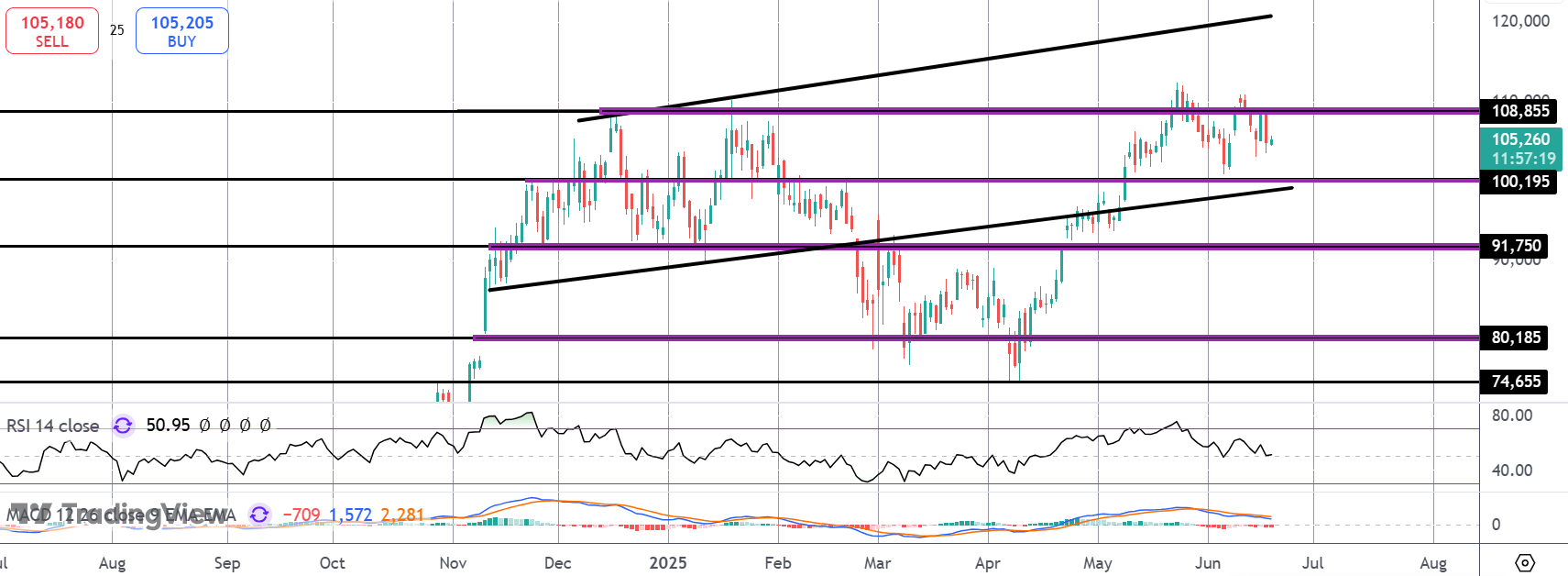

For now, price is holding between support at the $100k level, with the bull channel lows there to, and resistance at the $108,855 level. While support holds, focus remains on an eventual break higher, given the broad bull trend. To the topside, $120k and the channel highs will be the initial target. If we break lower, $91,750 will be the deeper support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.