Bitcoin Bulls Celebrate As Breakout Gathers Pace

BTC Breakout Continues

Bitcoin prices continue to surge higher into fresh, record territory today with the futures market gapping higher today by almost 3%. BTC is now up almost 10% on the week and almost 60% off the YTD lows. A major driver of the current push higher is the soaring institutional demand we’re seeing. Bitcoin ETF inflows have continued to gather pace recently with mainstream names keen to gain exposure ahead of an expected bull run in Bitcoin.

High Profile Buying

High profile, large scale buying from names such as Strategy (largest global holder) and Meta Planet have amplified bullish sentiment among investors, bolstered by increasingly pro-crypto political developments in the US. Indeed, there has also been strong buying recently from nation states as countries look to add BTC to their currency reserves amidst declining BTC supply levels and expectations of much higher prices in coming years.

Trader Sentiment & Order Flow Dynamics

Breakout moves in Bitcoin are often accompanied by a lot of noise from mainstream media which tends to fuel a surge in retail buying. This has typically led to instability in BTC rallies and volatile price tops. However, for now it seems the rally is not yet being driven by this dynamic. On-Chain data analytics point to more muted levels of buying from smaller accounts, meaning the current move is being driven by bigger players and therefore more sustainable.

Technical Views

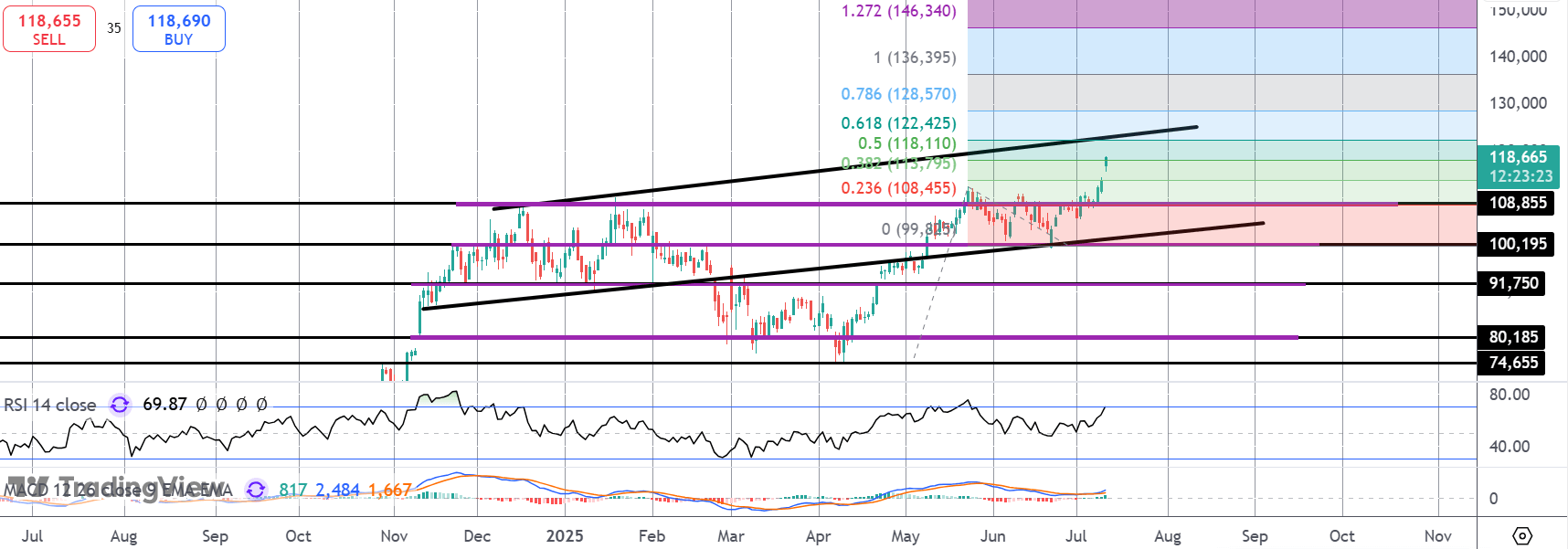

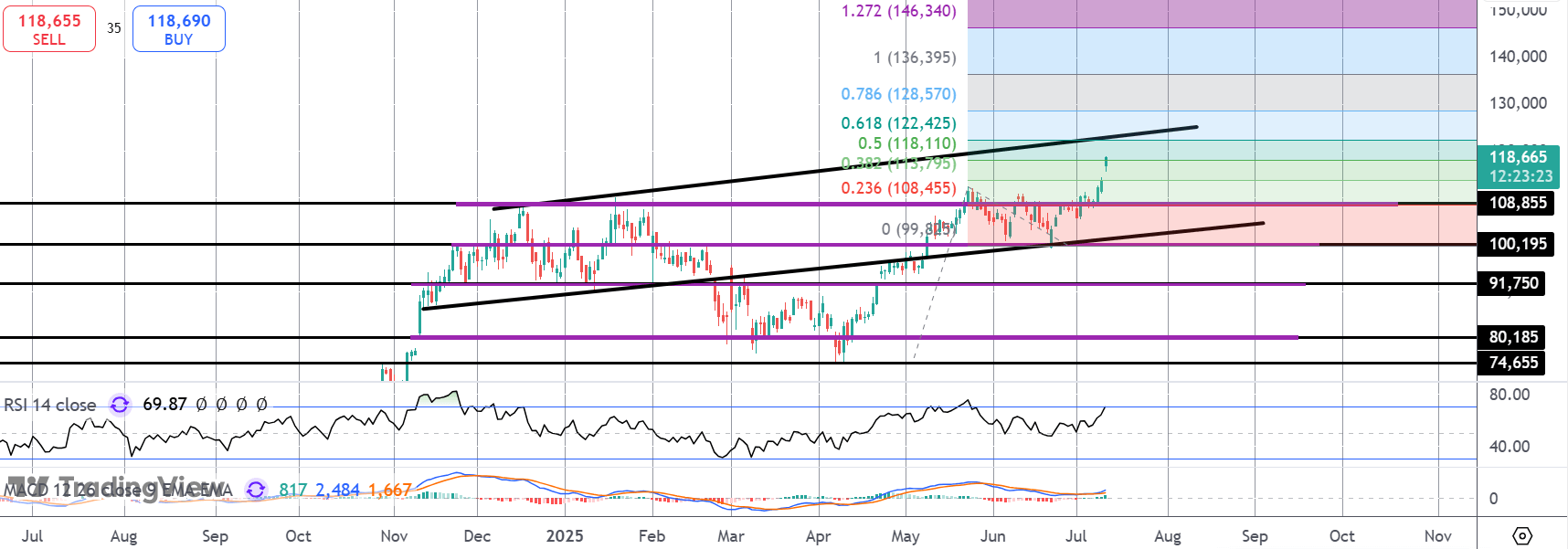

BTC

The rally in BTC has seen price surging higher to just shy of testing the $120k mark. The bull channel highs sit above as the only notable resistance ahead of the $136,395 100% Fib extension level. With momentum studies pushing higher, focus is on further upside while price holds above the $108,855 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.