Weak USD Drives BTC

The sharp shift lower in USD on the back of the December FOMC yesterday has been welcomed by crypto traders. BTC rallied more than 6% on the day and is now up more than 7% off the week’s lows. With US rate cuts now clearly on the horizon, risk assets are in fine form today with improvements across the board. Following the recent correction lower in BTC it seems that bulls are rejoining the market with the prospect of a fresh breakout now looming.

SEC Approval Still Looms

The broader backdrop for BTC remains focused on the upcoming SEC ETF decision due in January. Having delayed decisions on the current applications in November, crypto markets have continued to edge higher driven by a sense of optimism that the SEC will approve some/all of the applications. If this proves true in January, this aspect combined with US rate cut expectations should help drive BTC higher through Q1. However, if the SEC turns down the applications or finds a way to further delay its decision, this will likely fuel a near-term unwinding of BTC as traders reassess and wait for a clearer signal.

BlackRock Adjusts its ETF

One interesting development this week was the change announced by BlackRock to the mechanics of its ETF model. The change would essentially allow participation from major Wall Street banks, currently prohibited from holding Bitcoin, by allowing them to create new fund shares in cash rather than crypto. This potentially amplifies the level of demand BlackRock might see for its ETF, which should in turn drive BTC higher.

Technical Views

Bitcoin

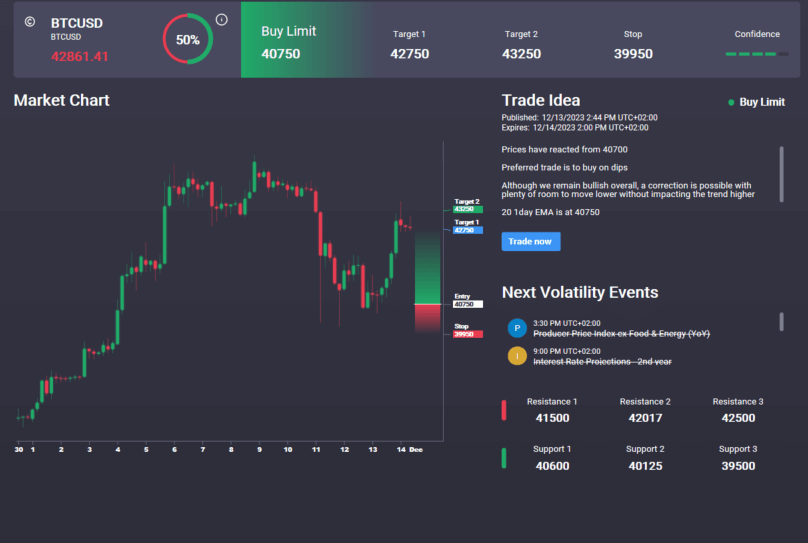

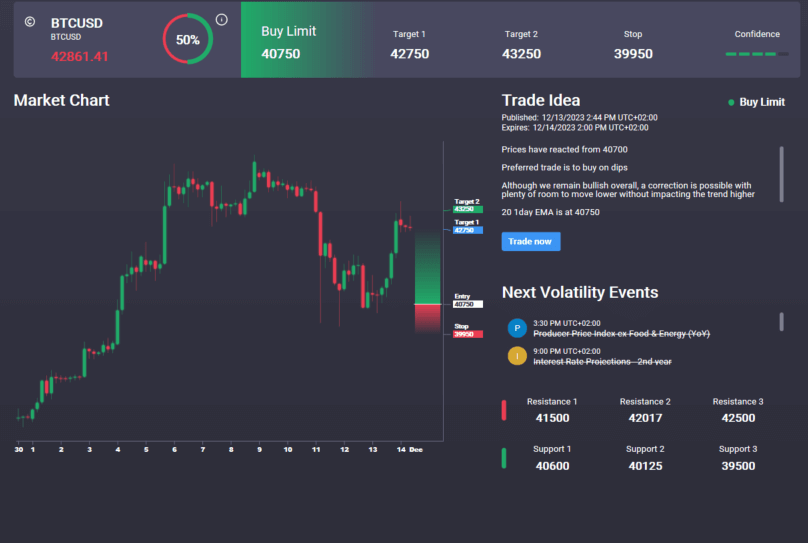

BTC is currently sitting just below YTD high, above the broken bull channel highs and the 39860 resistance level, now support. While this level holds, the focus remains on further upside with a break of 45530 the next objective for bulls. To the downside, a break back under the channel highs will turn focus to 37030 next. Notably, we have a buy signal in the Signal Centre today set at 40750, suggesting a preference to buy dips.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.