LSE News Sends Bitcoin Higher

Bitcoin prices are softening a little over early European trading on Tuesday following another strong rally yesterday which saw BTC futures breaking out to fresh, record highs above the $73k mark. Yesterday’s rally came amidst news that the London Stock Exchange has opened the door to UK Bitcoin ETFs. On the back of the SEC granting approval to a slew of spot-Bitcoin ETFs in January, the LSE announced yesterday that it would welcome similar UK based ETNs and will begin accepting applications from next month.

Fresh Demand Hopes

Given the huge demand we have seen for US-based bitcoin ETFs, Bitcoin bulls are hopeful of a fresh wave of demand entering the market from the UK and Europe. The latest data from CoinShares shows that ETF inflows topped $10 billion this week with a record $2.7 billion coming in as demand continues to build. A combination of expected Fed easing this year and the optimism over the upcoming Bitcoin halving event in April are fuelling the surge in demand for BTC currently.

US Inflation Next

Looking ahead today, focus will be on the latest US inflation data. Should data undershoot forecasts, this should increase the chances of a H1 rate cut from the Fed, pulling USD lower and giving Bitcoin fresh incentive to rally. However, should data come in at or above forecasts today this could open the door to some near-term profit taking in Bitcoin as USD stabilises. Given the broader backdrop, however, any correction lower today is likely to find demand at lower levels keeping the bull trend intact.

Technical Views

BTC

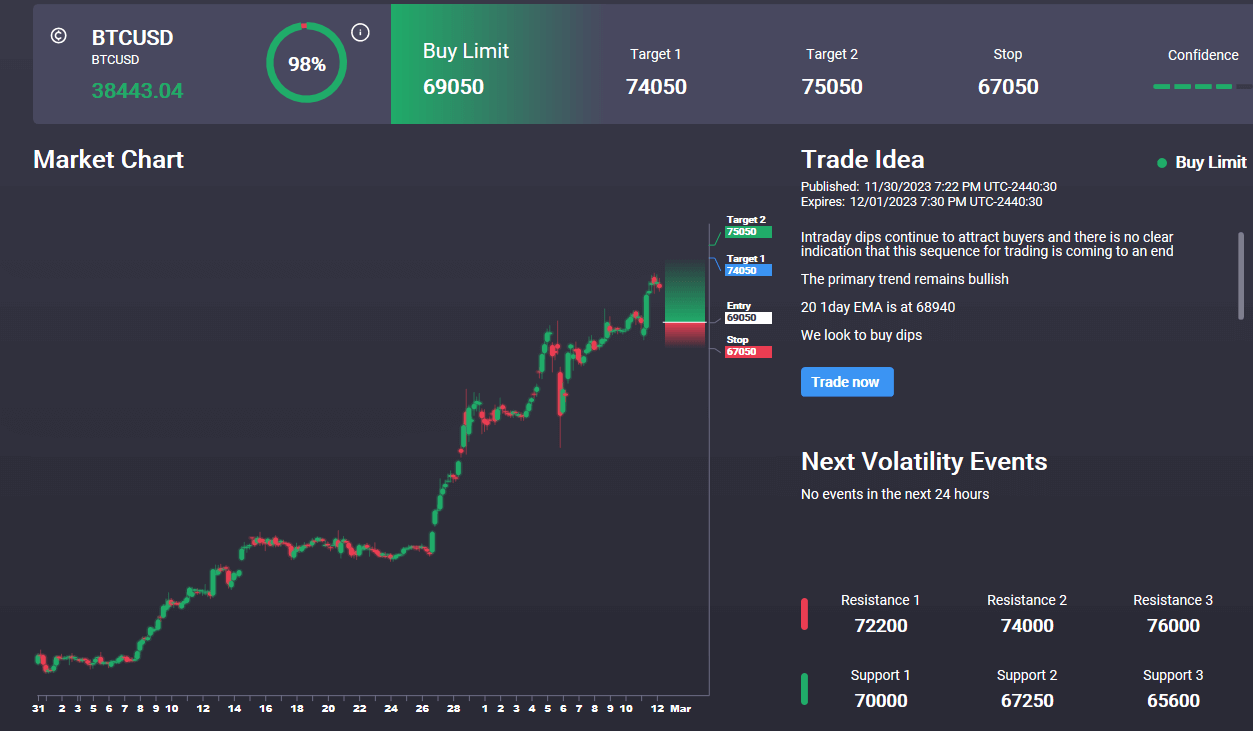

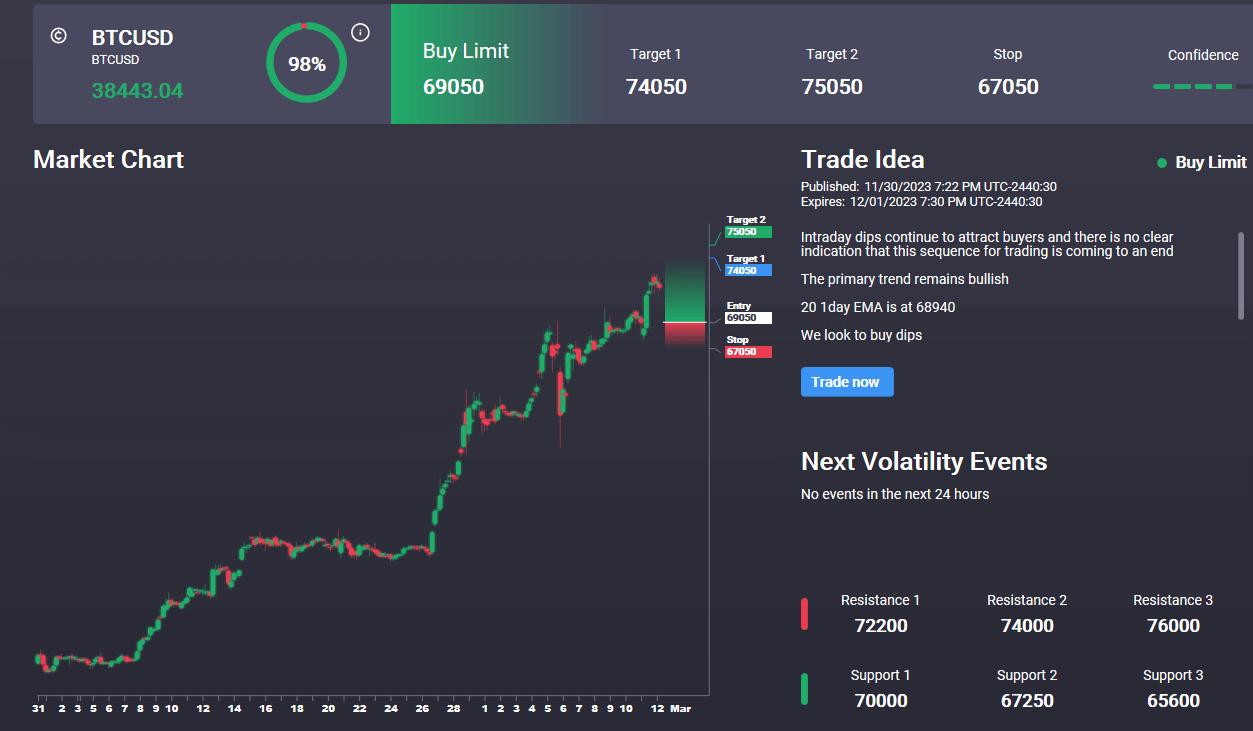

The rally in BTC has seen price blowing through resistance levels recently with the market now holding above the prior 99355 highs. With momentum studies bullish, the focus is on further upside while we hold above that level. In terms of projecting potential price pivot zones, the 1.25% Fib extension at 81940 looks to be a decent target for bulls to play for near-term. Notably, we have an active buy signal in the Signal Centre today set at 69050 suggesting a preference to buy any dips from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.