Aussie Rates At Highest Level Since 2012

The Aussie is soaring today on the back of the RBA unexpectedly announcing a fresh rate hike at its May meeting overnight. The bank hiked rates from 3.6% to 3.85%, marking their highest level since 2012, despite having made the decision at the prior meeting to keep rates on hold, which it was widely expected to do again today. Perhaps more confusingly, the hike comes on the back of Australian inflation having fallen lower last month. However, explaining the decision, RBA governor Lowe said that while inflation has likely peaked, it is still not coming down fast enough and, at 7%, remains well above the bank’s 2% - 3% target. The RBA noted strength in the labour market, population increases and higher property prices as contributing factors to its decision.

Looking at the broader central bank backdrop, the move has been interpreted as a necessary adjustment ahead of further expected rate hikes from the Fed and ECB this week. Consequently, the outlook for the RBA regarding further hikes will likely largely depend on the Fed tomorrow and whether they signal any further hikes are likely. AUD is moving sharply higher against both USD and EUR today, indeed, across the board, and looks poised for further gains near term if risk sentiment remains supportive.

Technical Views

AUDUSD

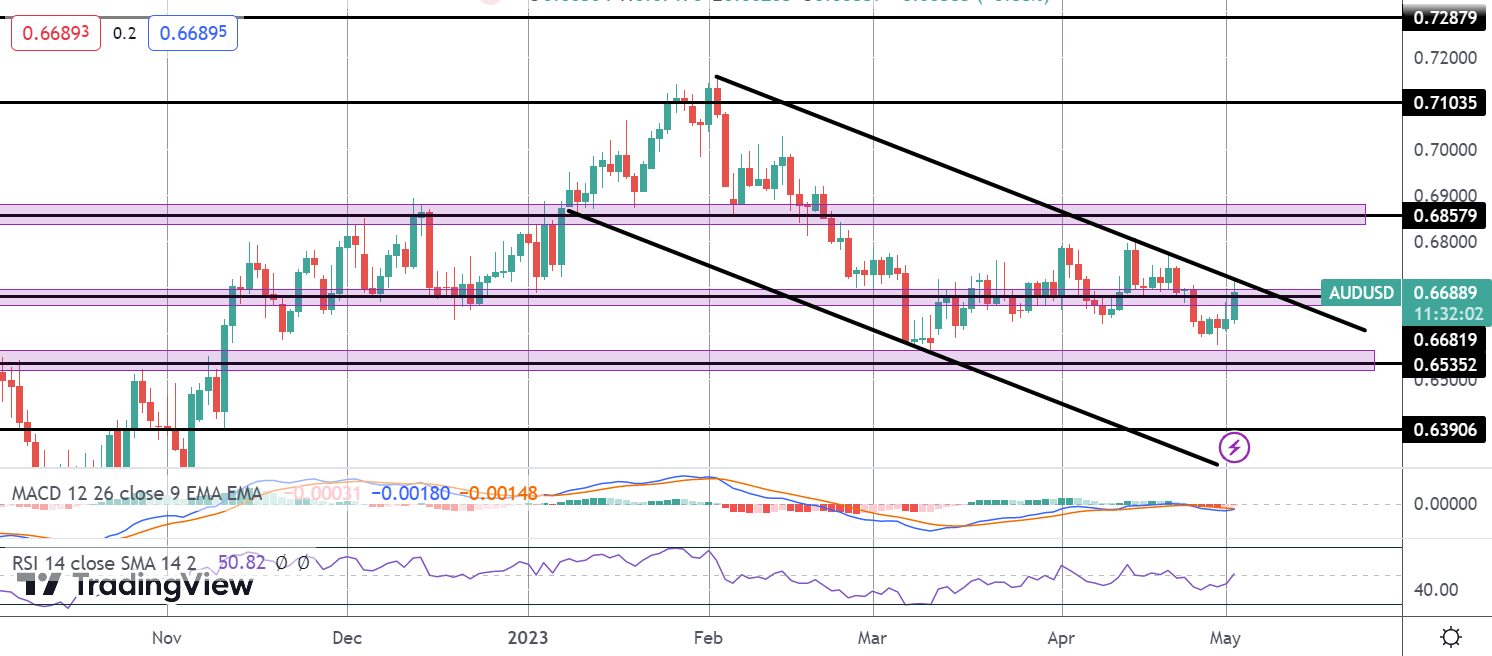

The sell off in the Aussie from YTD highs has seen the pair grinding lower within a clear bearish channel. The decline has recently stalled along the .6535 level support with the pair now trying to break back above .6681 and the channel highs. If seen, focus will turn to .6857 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.