Aussie Pops On Surprise RBA Hold

RBA Holds Rates

AUDUSD is trading sharply higher today with the pair almost entirely reversing yesterday’s losses. The move comes amidst an unexpected decision by the RBA to keep rates on hold. Traders had been positioning themselves in expectation of a further .25% cut. However, the bank caught traders off-guard, warning that it needed to be cautious with further easing and would instead, for now, monitor ongoing risks before taking any fresh action. In particular, the bank judged that inflation risks had become more balanced recently and wanted to see data on Q2 prices (due end of July).

Shifting Tariff Outlook

Alongside the shock decision to hold rates unchanged, AUD is also being helped today by better risk appetite. It seems the market’s view on US tariff risks is shifting. The pause on Trump’s ‘Liberation Day’ tariffs is due to end tomorrow, with reciprocal tariffs set to be reactivated from August 1st. However, traders are sensing that there is room for negotiation ahead of that date with news already that some trading partners, such as the EU will be able to secure better terms than previously thought. With the overall tariff action now expected to be less severe, risk assets are rebounding on Tuesday, underpinning AUD for now.

Technical Views

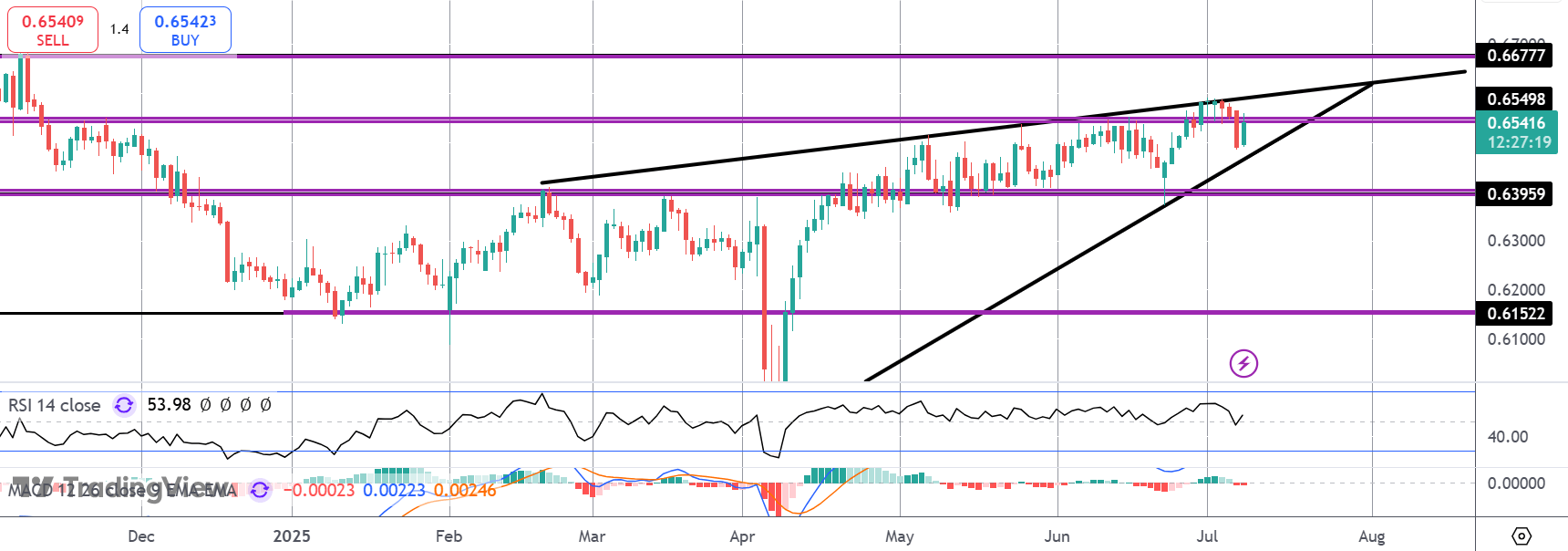

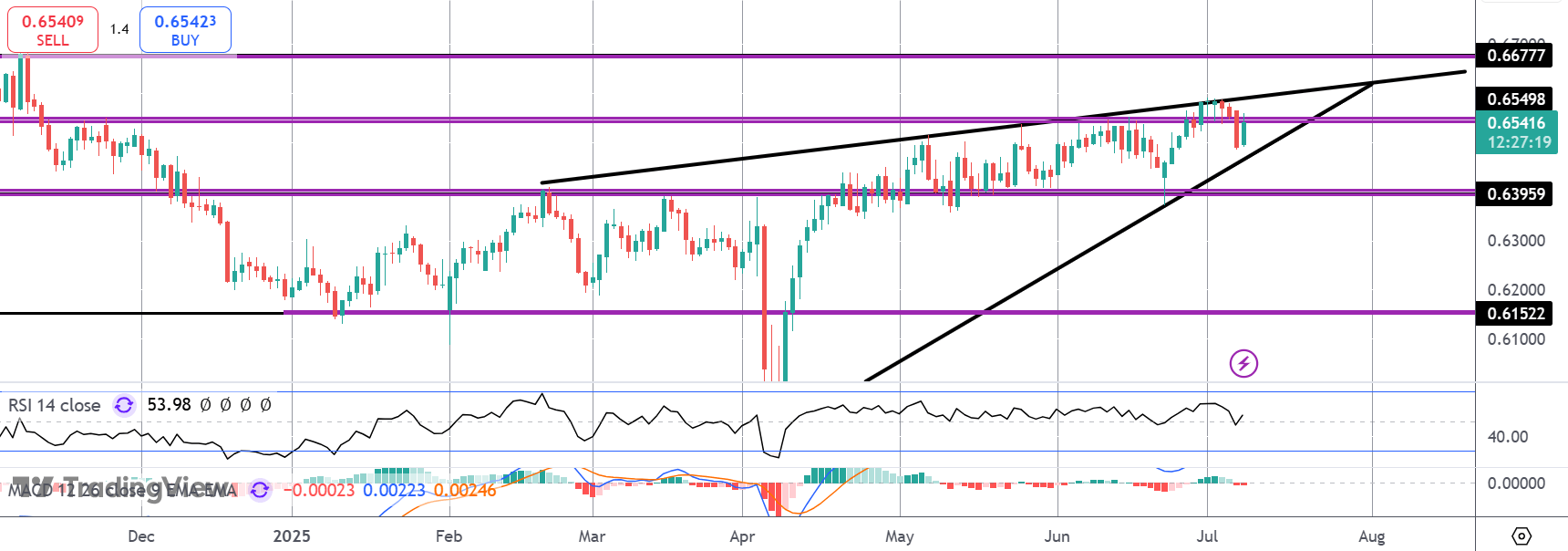

AUDUSD

For now, AUDUSD remains within the rising edge formation, capped by the .6549 level resistance. While this resistance holds, risks of a downside break remain with .6395 the nest support level to watch. Should we push higher here, .6677 will be the next objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.