As we begin the year we’re taking a look into the outlooks for a number of currency pairs. This is our EURUSD Index Q1 Outlook 2020.

Fundamentally Speaking

Outlook: The Eurozone economy had a subdued fourth quarter in 2019. Preliminary flash GDP revealed a modest gain, a tick above expectations, but still equaling the worst performance since it last contracted back at the start of 2013. Italy and France both topped expectations respectively, whilst Spain maintained a relatively solid expansion. Importantly, Germany managed to dodge a recession, with growth coming in ahead of consensus, after suffering a revised contraction in the second quarter of 2019. That said, the Eurozone’s composite PMI for November remains barely in expansionary territory, down from October. More worrying was that the services sector has also become more affected by the slowdown, with the services PMI falling to a 10-month low in November. Expectations for growth in the Eurozone are though to lose further momentum. Germany, the Eurozone's largest economy, is still teetering on the verge of a recession as a result of a continued downturn in manufacturing and subdued global automobile sales. On the external front, the Eurozone’s export dependence makes it highly vulnerable to US-China trade tensions and the overall global economic slowdown, however, with a phase one deal likely inked early 2020 GDP growth looks like it may stabilise at depressed levels.

Central Banking

Markets anticipate rates to remain unchanged until end-2021. Lagarde may not have to change policy for some time as the latest stimulus package remains in play; but providing more stimulus further out could be complicated because so much of the ECB’s balance sheet has already been deployed. The ECB’s deposit rate is already at a record low and its bond-buying programme is close to self-imposed limits on how much of each country’s debt it can own. Further complicating Lagarde’s role is the fact that the ECB’s decision in September to cut interest rates and to print EUR20bn a month to buy more bonds has led to unusually strong criticism from several members on the ECB governing board.

Technical Takeaway

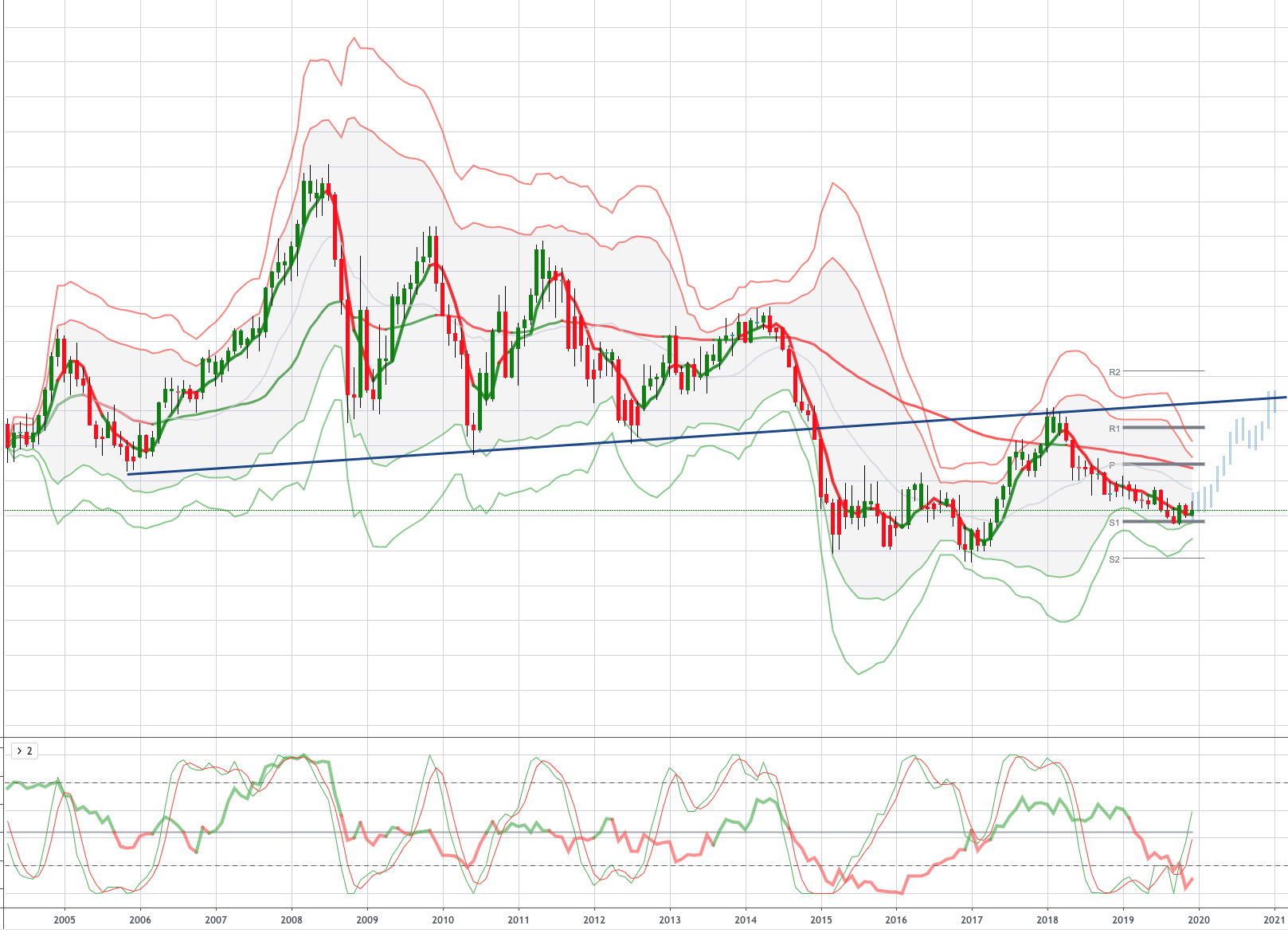

If we use the previous QEs by the ECB from 2015-2018 serves as a guide, EURUSD may continue to stabilize after the bond purchases commenced in November. Indeed, markets have looked beyond a dim Eurozone outlook and EURUSD has shown tentative signs that an interim bottom has been in place at 1.09. Likewise, options markets are also warming up to prospects of a higher EUR, with risk reversals briefly topping at the highest levels since March 2018 in favor of EUR over the USD. Together with a broad topping out of USD against most Majors, I maintain a constructive view of EURUSD stabilizing around 1.11 in the first quarter of 2020 followed by a rebound to 1.15 then 1.25 later in the year.

Check out our Q1 Outlooks for EURUSD, GBPUSD, USDJPY and the USD Index.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!