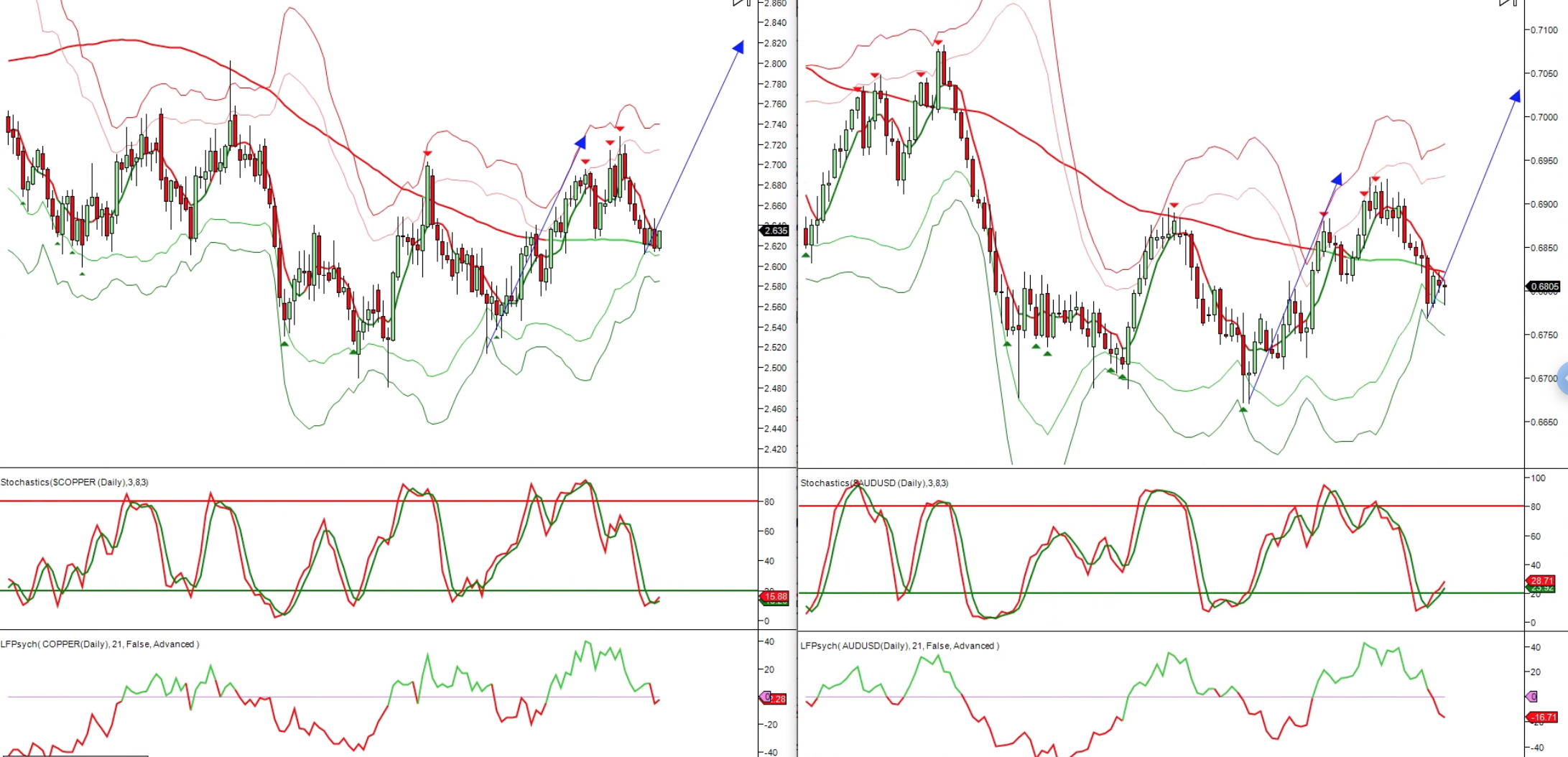

Chart of the Day - AUDUSD

AUD: RBA minutes repeated that the Bank is assessing earlier cuts as it remains prepared to ease further. The Minutes echoed the November Statement on Monetary Policy, where the Board noted low rates meant it was approaching the limits of conventional policy, bringing closer the point at which “other policy options might come into play”. The minutes elaborated somewhat on these limits, although more detail will likely be covered in Governor Lowe’s 26 November speech on unconventional policy. Australian Treasurer Frydenberg’s key messages from his planned speech before the Committee for Economic Development of Australia today. The article notes that Treasurer makes the case for keeping the budget in surplus not just to cope with current demands but also because of the long-term challenges, especially the "economic time bomb" of an ageing population. Ahead of the mid budget in December the Treasurer is signalling that we shouldn’t expect a big splash in spending. The article adds that that neither fast-tracked income tax cuts nor the promised investment allowance for business will be in the MYEFO.

USD: Global bonds advanced by and large, amid lingering trade jitteries after Beijing said it was pessimistic on a US-China trade deal. The UST curve shifted lower by 1-2bnps with the 10Y paring about 2bps to 1.815%. The fall in US rates appears to have weighed on the USD, which has fallen 0.2%-0.3%, in index terms, to start the week. The USD indices have fallen around 0.6% over the past week as the US 10 year Treasury yield has fallen from around 1.95% to 1.8%. The USD indices remain well contained towards the middle of the trading ranges over the past six months. Fed Chair Powell met Trump at the White House. Trump said they had a “very good and cordial” meeting spanning topics including trade, low inflation and negative interest rates. A Fed statement said Powell’s comments were consistent with his recent public remarks and the policy rate outlook was data dependent.

From a technical and trading perspective, the AUDUSD is testing pivotal support below the .6800 level (which represents a 61.8% retracement of the October advance), bids continue to emerge at this level and as such encourage the view that the October advance was impulsive and the early-mid November pull back is corrective preceding another leg of upside which should see offers and stops above .7000. I also note a similar pattern developing in the Copper chart this confluence supports the near term AUDUSD bullish bias. I will venture long through .6835 with a stop below today’s low targeting the .7000 level

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!