Chart of the Week Bullish EURUSD

Bullish EURUSD: EUR: Eurozone industrial production is out on Wednesday. On Thursday, national account data for 3Q19 will be updated with the second estimate of the 3Q real GDP growth set to confirm the flash 0.2% q/q growth. On Friday, alongside the trade balance data for September, Eurostat will provide the final reading of HICP inflation for October. At the national level, Germany releases it ZEW survey on Tuesday, followed by flash estimates of October HICP inflation on Wednesday. The most important French data are released on Thursday, including labour market data for 3Q19 and flash estimates of October HICP inflation

USD: US domestic politics will stay on the impeachment inquiry into US President Donald Trump as the House of Representatives will televise publicly the Congressional hearings on President Trump's impeachment inquiry this week. US diplomats William Taylor and George Kent will testify before the House of Representative Intelligence Committee on Wednesday, whilst the former US ambassador to Ukraine Marie Yovanovitch will testify on Friday. All three diplomats have already testified behind closed doors. That said, the market continues to see it unlikely that the Republican-controlled Senate would convict President Trump.

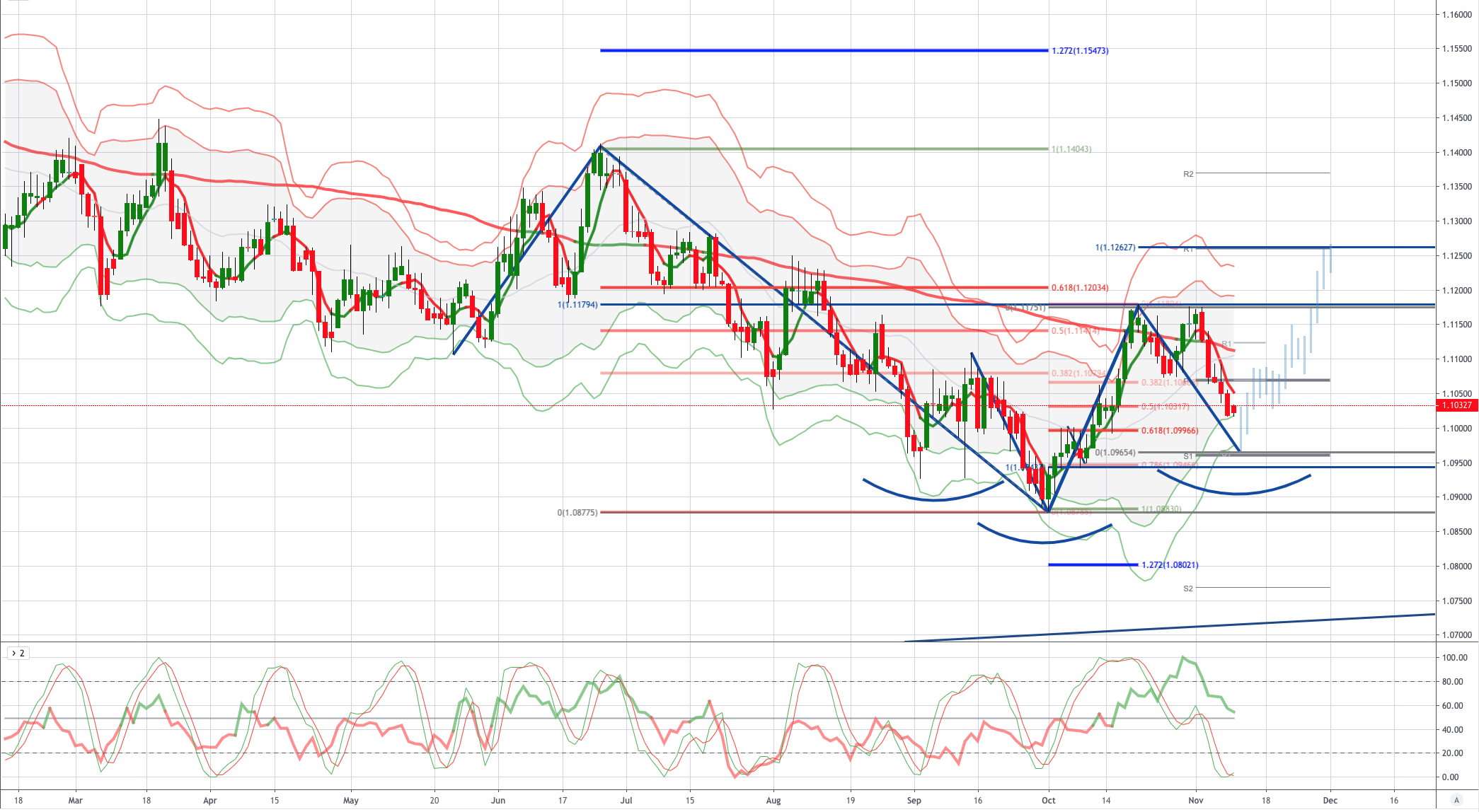

From a technical and trading perspective the EURUSD looks poised to test symmetry swing and Fibonacci support sited at 1.0965 where I will be looking for bullish reversal patterns, confirming a potentially inverse head and shoulders scenario, to set long positions playing for a second leg of upside the single currency, initially targeting a retest of prior highs at 1.1180 and then to test the equidistant swing objective at 1.1250. Thursday sees 3nillion Euros worth of options expiring at the 1.1150n strike, ideally we test the 1.0965 bid zone ahead of Thursday. On the CFTC front, the investment community was split over the USD in the latest week. Longer term, asset manager accounts took a big step against the USD, increasing their net short USD bias significantly. But the shorter term players were mixed with leveraged accounts slightly increasing their net implied long USD bias, but noncommercial accounts slightly reduced them.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!