10-Year U.S. Treasury Yields Decline: What’s Next?

The yield of the 10-year U.S. Treasury Bond broke the uptrend, tested it, and dropped. Now, it is testing the level of 4.313% and trying to break it through. Also, should the asset break this level, its yield might dive even deeper and gain the required support at the level of 3.785%. The rate of this asset usually goes up when its yield is heading down, and vice versa. So, let’s observe what might happen next.

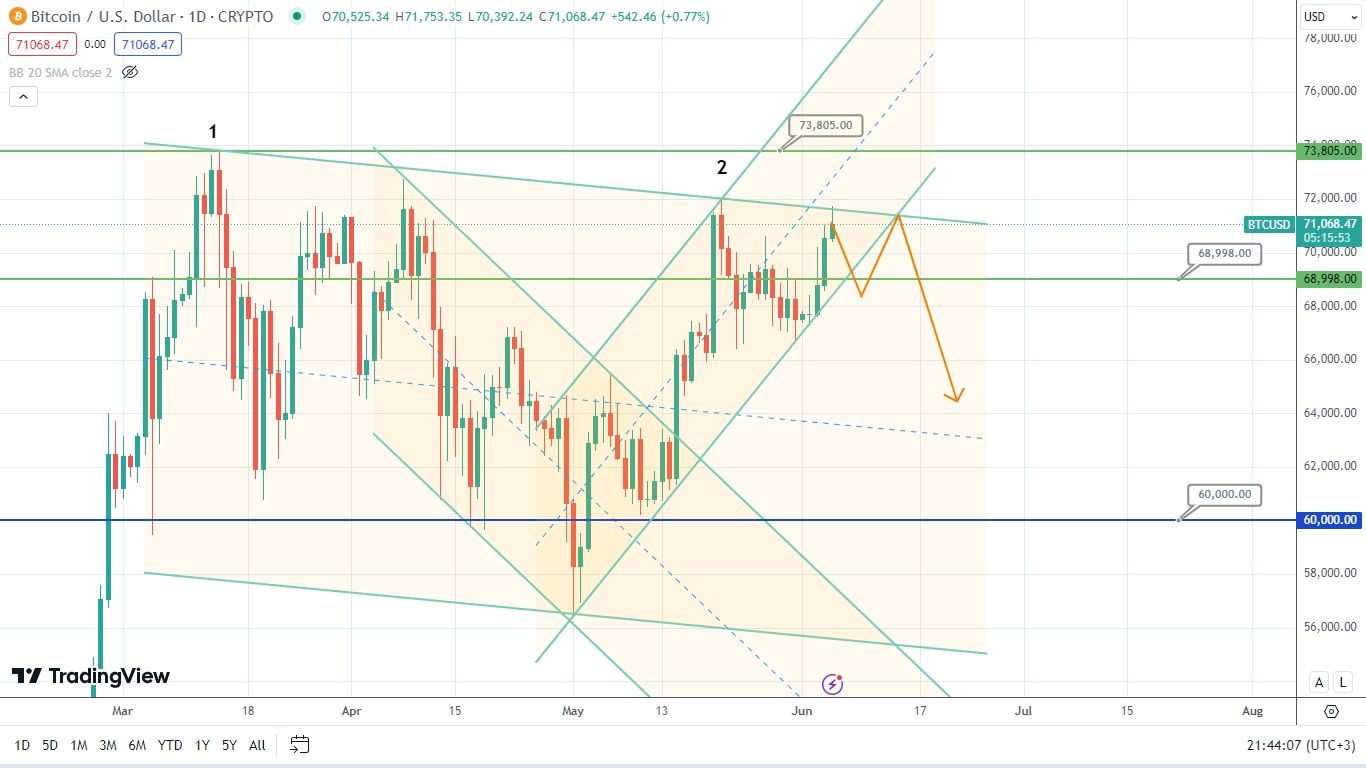

The price of Bitcoin has tested the flat downtrend. It might potentially target the local uptrend next. After that, it could try to test and break through this uptrend, rebound at the crossing point of the downtrend and broken uptrend, and drop. The bulls are trying to seize the bearish initiative now, but to no avail. So, it would be wise to observe the next price movement of this asset to forecast the upcoming sentiment.

Amazon’s stock price remains in the range, although it might head north soon. Should the asset’s price enter the resistance area formed between levels 191.70 and 189.77, it might undergo a long-term correction and drop. Time will tell what is going to happen next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.